Can I Charge A Credit Card Processing Fee?

Posted: 02 Apr 2025 on General

Yes, you can charge a credit card processing fee.

Can I Charge a Credit Card Processing Fee?

The short answer is, in most cases, yes, you can charge a credit card processing fee. However, there are a few things you need to keep in mind before you do so. First, you need to make sure that your customers are aware of the fee and that they agree to pay it. Second, you need to be transparent about the fee and how it will be used. Finally, you need to make sure that the fee is reasonable. If you follow these guidelines, you can charge a credit card processing fee without any problems.

Benefits of Charging a Credit Card Processing Fee

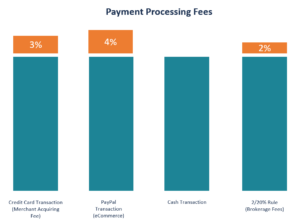

There are several benefits to charging a credit card processing fee. First, it can help you offset the cost of accepting credit cards. The average cost of processing a credit card transaction is 2-3%, so if you charge a processing fee of 2%, you can recoup most of the cost of processing the transaction. Second, charging a processing fee can help you reduce the risk of fraud. Fraudulent transactions are more likely to be made with stolen credit cards, and if you charge a processing fee, you can make it more difficult for fraudsters to profit from their crimes. Finally, charging a processing fee can help you improve your cash flow. When you accept credit cards, you typically have to wait for the funds to clear before you can access them. However, if you charge a processing fee, you can access the funds immediately.

How to Charge a Credit Card Processing Fee

There are two ways to charge a credit card processing fee. The first way is to add the fee to the total amount of the transaction. For example, if the total cost of the transaction is $100, you can add a $2 processing fee, making the total cost of the transaction $102. The second way to charge a credit card processing fee is to add the fee as a separate line item on the invoice. For example, you could list the total cost of the transaction as $100 and then add a $2 processing fee line item. Either way, you choose to charge the fee, it’s important to be transparent about it. Make sure that your customers are aware of the fee and that they agree to pay it before you process the transaction.

How Much Can I Charge?

The amount you can charge for a credit card processing fee depends on several factors, including the type of business you are in, the amount of your average transaction, and the fees charged by your credit card processor. However, as a general rule of thumb, most businesses charge a processing fee of 2-3%. If you charge more than 3%, you may lose customers who are unwilling to pay the high fee. Additionally, charging a high processing fee may violate the terms of your agreement with your credit card processor.

Conclusion

Charging a credit card processing fee can be a great way to offset the cost of accepting credit cards, reduce the risk of fraud, and improve your cash flow. However, it’s important to do so in a way that is transparent and reasonable. By following the guidelines in this article, you can charge a credit card processing fee without any problems.

Can I Charge a Credit Card Processing Fee?

The answer is a resounding yes! Businesses of all sizes can charge a credit card processing fee to offset the costs associated with accepting credit cards. However, there are a few legal considerations that merchants must keep in mind when implementing a credit card processing fee.

Legal Considerations

Merchants must comply with all applicable laws and regulations when charging a credit card processing fee. The most important requirement is that merchants must provide clear and conspicuous notice to customers that a fee will be charged. This notice must be displayed at the point of sale and on any receipts or invoices.

In addition to providing notice to customers, merchants must also comply with the following laws and regulations:

- The Truth in Lending Act (TILA) requires merchants to disclose the amount of any credit card processing fee in a clear and conspicuous manner.

- The Electronic Fund Transfer Act (EFTA) prohibits merchants from charging a credit card processing fee that exceeds the cost of processing the transaction.

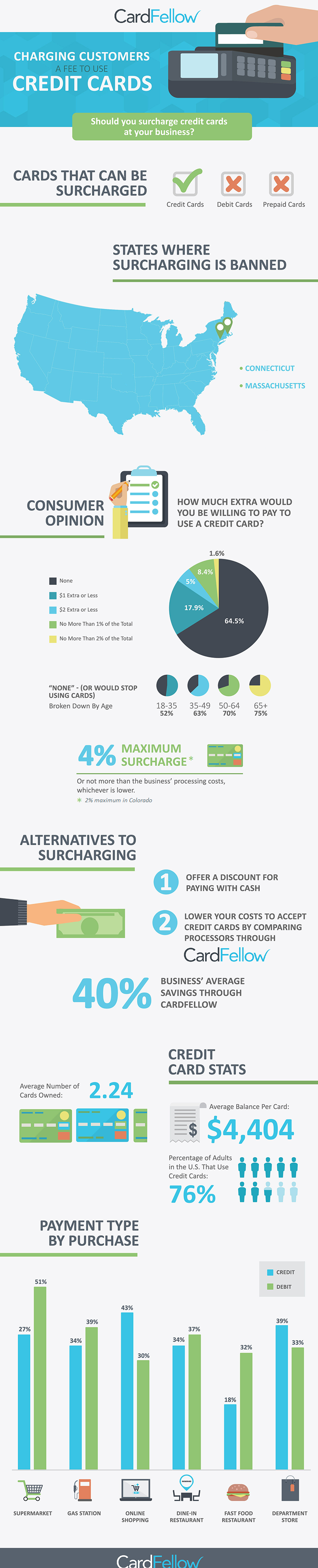

- The Dodd-Frank Wall Street Reform and Consumer Protection Act prohibits merchants from charging a credit card processing fee for debit card transactions.

Best Practices for Charging a Credit Card Processing Fee

In addition to complying with all applicable laws and regulations, merchants should also follow these best practices when charging a credit card processing fee:

- Keep the fee amount reasonable. The fee should not be so high that it discourages customers from using credit cards.

- Be transparent about the fee. Don’t try to hide the fee in the fine print. Make sure customers are aware of the fee before they complete their purchase.

- Offer alternative payment methods. Customers who are not willing to pay a credit card processing fee should be offered alternative payment methods, such as cash or check.

Benefits of Charging a Credit Card Processing Fee

There are several benefits to charging a credit card processing fee. These benefits include:

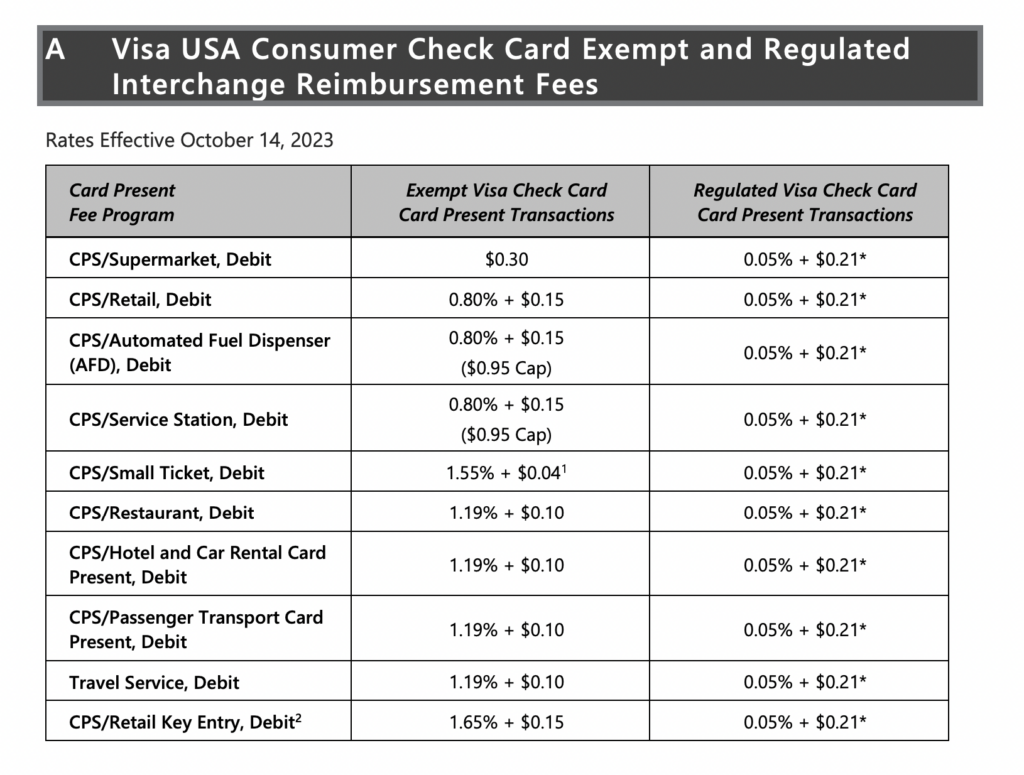

- **Offsetting the costs of accepting credit cards**. Credit card processing fees can help merchants offset the costs of accepting credit cards, such as the interchange fees charged by credit card networks and the costs of processing transactions.

- **Encouraging customers to use alternative payment methods**. By charging a credit card processing fee, merchants can encourage customers to use alternative payment methods, such as cash or check, which have lower processing costs.

- **Simplifying accounting**. Charging a credit card processing fee can help merchants simplify their accounting by reducing the number of different types of transactions that need to be processed.

Conclusion

Charging a credit card processing fee can be a beneficial way for merchants to offset the costs of accepting credit cards. However, merchants must comply with all applicable laws and regulations when charging a credit card processing fee. By following the best practices outlined in this article, merchants can implement a credit card processing fee that is both compliant and effective.

Can I Charge a Credit Card Processing Fee?

In a business, every decision we make has a potential impact on our customers. That’s why it’s so vital to think through the consequences of our actions before we decide to go through with them. One issue that many businesses face is whether or not they should charge a credit card processing fee. There is no easy answer to this question, as it will vary depending on many factors, but it is something that all businesses should consider carefully before making a decision.

Customer Impact

Customers may be less likely to make purchases if they are charged a processing fee, so merchants should carefully consider the potential impact on sales. Research shows that about 80% of customers surveyed said they would be less likely to shop at a store that charges a credit card processing fee. Wow, that’s a pretty big number! It’s important to weigh the potential loss of sales against the potential increase in revenue from the processing fee. You don’t want to end up shooting yourself in the foot. In other words, you want to make sure that the processing fee is actually going to increase your profits, not decrease them.

Legal Considerations

In addition to the potential impact on sales, there are also a number of legal considerations that businesses should be aware of before charging a credit card processing fee. Some states have laws that prohibit businesses from passing on the cost of processing credit cards to customers. In other states, there are certain restrictions on how much businesses can charge. Well, shoot! It’s important to check the laws in your state before charging a processing fee. You don’t want to get into hot water with the law.

Alternative Methods

If you are concerned about the potential impact of a processing fee on your customers, there are a number of alternative methods that you can use to offset the cost of processing credit cards. One option is to offer a discount for customers who pay with cash or debit. This is a great way to encourage customers to use alternative payment methods, and it can also save you money on processing fees. Well, what do you know? It’s a win-win!

Another option is to increase your prices slightly to cover the cost of processing fees. This is a less direct approach, but it can be effective if you are careful not to raise your prices too much. It’s all about finding that happy medium.

Finally, you can also negotiate with your credit card processor to get a lower processing rate. This can be a good option if you have a high volume of credit card sales. You might be surprised at how much you can save by simply asking for a better deal. Who knows, you might just get lucky!

Conclusion

Ultimately, the decision of whether or not to charge a credit card processing fee is a complex one that should be made on a case-by-case basis. There are a number of factors that businesses should consider, including the potential impact on sales, the legal considerations, and the alternative methods available. By carefully considering all of these factors, businesses can make an informed decision that is right for their business.

Can I Charge a Credit Card Processing Fee?

In the realm of commerce, where every transaction tells a tale of exchange, the question of charging a credit card processing fee often arises. Like a modern-day toll collector on the digital highway, merchants ponder whether they can impose an additional charge on customers who choose the convenience of plastic. The answer, like a well-crafted mosaic, is not always straightforward and requires careful consideration of both legal and practical implications.

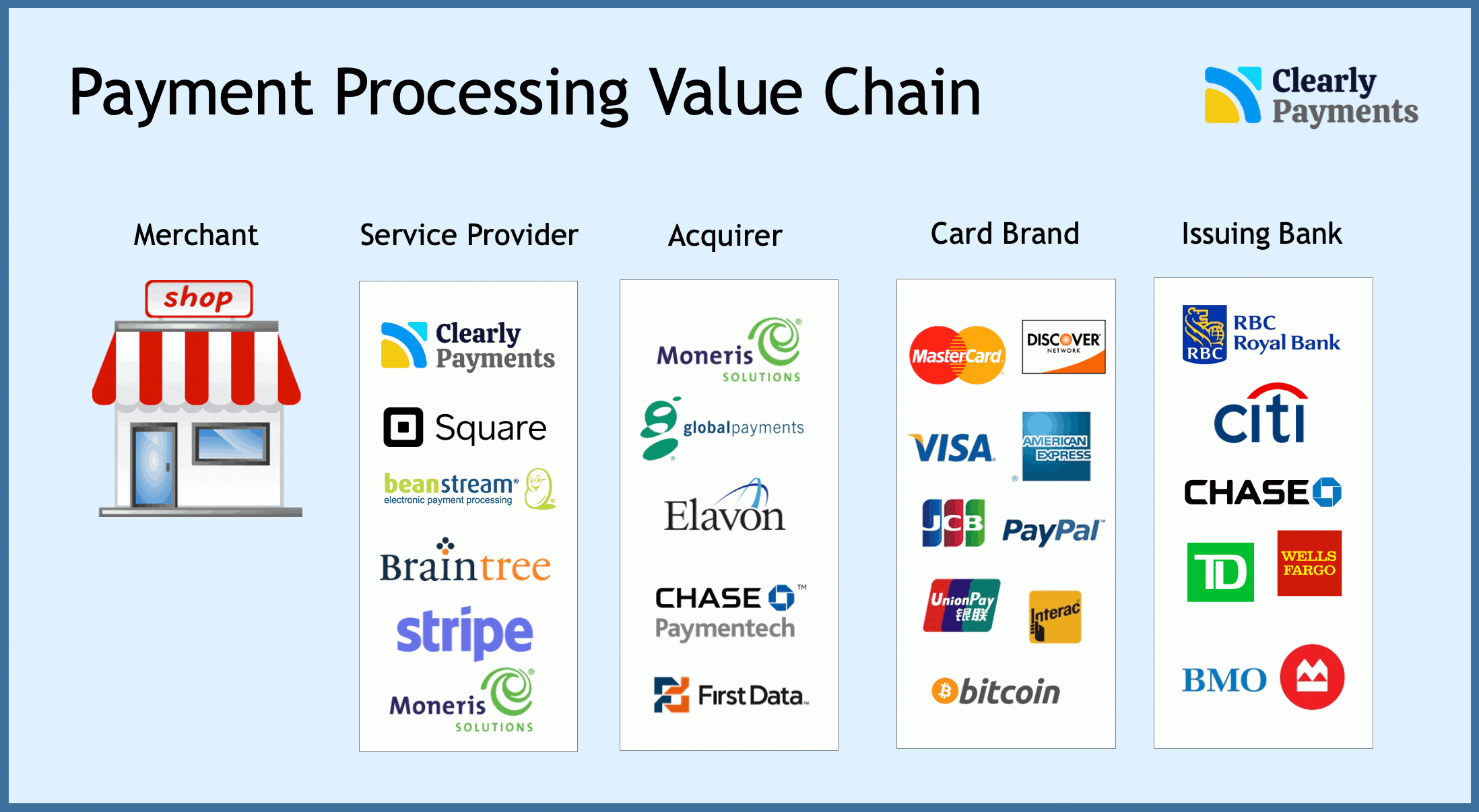

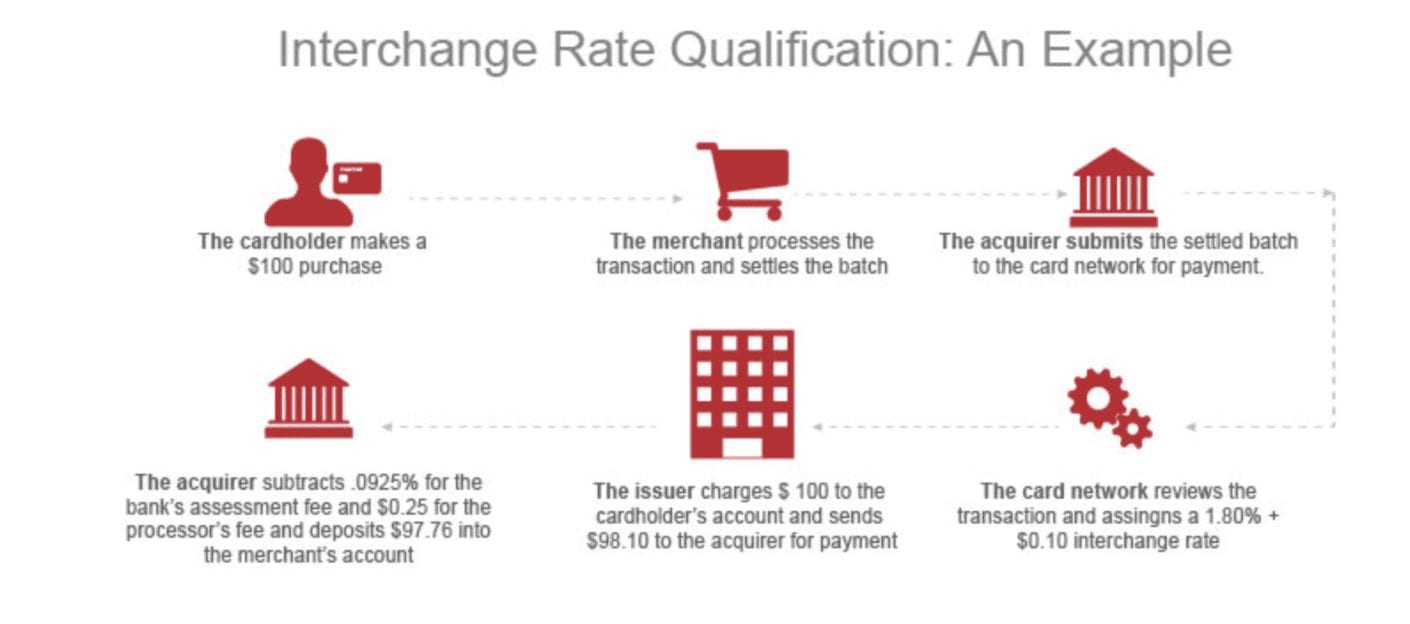

Understanding the Landscape

Before delving into the intricacies of processing fees, it’s essential to establish a clear understanding of the landscape. Credit card processing fees are typically charged by payment processors, the intermediaries who facilitate transactions between merchants and card networks. These fees, often expressed as a percentage of the transaction amount plus a flat fee, compensate processors for their services, which include authorization, settlement, and fraud prevention.

The Legal Perspective

The legal landscape surrounding credit card processing fees is a tapestry woven with both permissive and prohibitive threads. In general, merchants have the legal right to charge a processing fee. However, there are certain restrictions and disclosures that must be adhered to. For instance, merchants must clearly and conspicuously disclose the fee to customers before the transaction is complete. This disclosure can be included on receipts, invoices, or prominently displayed signage at the point of sale.

Balancing Interests

While merchants may have the legal right to charge a processing fee, it’s not always the wisest course of action. Like a double-edged sword, processing fees can cut both ways. On one hand, they can offset the costs associated with accepting credit cards. On the other hand, they can potentially deter customers who are sensitive to additional charges. Striking the right balance is akin to walking a tightrope, requiring careful consideration of the potential impact on sales and customer satisfaction.

Alternatives to Charging a Processing Fee

Merchants who wish to avoid the potential drawbacks of charging a processing fee can explore alternative methods of offsetting credit card processing costs. Like a skilled chef experimenting with flavors, merchants can experiment with various strategies. Raising prices slightly, for instance, can spread the burden of processing fees across all customers, making it less noticeable. Alternatively, offering discounts for cash payments can incentivize customers to use alternative payment methods, reducing the reliance on credit cards.

The Customer Perspective

When contemplating whether to charge a processing fee, merchants should don the mantle of empathy and consider the customer’s perspective. Customers, like discerning diners at a restaurant, appreciate transparency and value. By providing clear and upfront information about processing fees, merchants can build trust and foster a sense of fairness. Remember, a satisfied customer is like a loyal patron who keeps coming back for more.

Navigating the Nuances

Like a seasoned navigator charting a course through treacherous waters, merchants must carefully consider the nuances associated with charging a processing fee. Factors such as industry norms, customer demographics, and competitive landscape play a significant role in determining whether or not a processing fee is appropriate. For instance, in industries where processing fees are prevalent, customers may be more accepting of them. Similarly, merchants targeting high-end customers may be able to charge a processing fee without significantly impacting sales, as their customers are often less price-sensitive.

The Importance of Disclosure

Transparency, like a beacon of truth, is paramount when charging a processing fee. Merchants must clearly and conspicuously disclose the fee to customers before the transaction is complete. This disclosure should be easy to understand and readily available to customers. Failure to properly disclose the fee can not only damage customer trust but also lead to legal consequences. Remember, clarity breeds understanding and fosters a positive customer experience.

Exceptional Customer Service

Exceptional customer service is like a soothing balm that can mitigate the sting of a processing fee. Merchants who go above and beyond in providing outstanding customer service can help offset the negative impact of a processing fee. By promptly resolving customer inquiries, offering flexible payment options, and maintaining a positive attitude, merchants can create a memorable and satisfying shopping experience. After all, happy customers are more likely to overlook minor inconveniences.

A Balancing Act

Charging a credit card processing fee is a delicate balancing act, requiring merchants to weigh the potential benefits and drawbacks carefully. By understanding the legal landscape, considering alternative methods, and prioritizing customer satisfaction, merchants can make informed decisions that align with their business objectives. Remember, like a skilled chef, the key is finding the right recipe that satisfies both the merchant and the customer.