Credit Card Processing Fee Sign

Posted: 02 Apr 2025 on General

Credit Card Processing Fee Sign: A Beacon of Transparency

In the realm of commerce, where every transaction tells a tale, the credit card processing fee sign stands as a beacon of transparency. It’s a silent sentinel, informing customers of the hidden costs that lurk beneath the surface of every swipe or tap. Like a candid accountant, it reveals the truth behind the convenience of plastic, shedding light on the fees that businesses incur to process electronic payments.

This unassuming sign serves as a constant reminder that even in the digital age, money doesn’t grow on trees. It’s a stark contrast to the allure of cashless transactions, where the seamless nature of electronic payments can lull us into a false sense of costlessness. The credit card processing fee sign acts as a reality check, reminding us that convenience comes at a price.

The High Cost of Credit Card Processing Fees

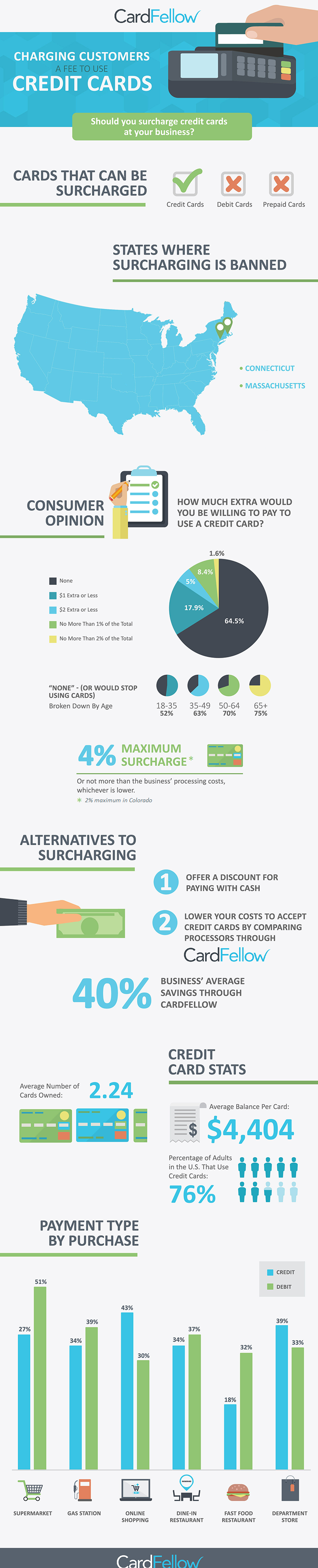

Credit card processing fees are not mere trifles; they can be a hefty burden on businesses, especially small ones operating on razor-thin margins. These fees vary widely depending on factors such as the card type, transaction amount, and payment processor used. However, one thing remains constant: they can add up quickly, eating into profits like termites in a wooden beam.

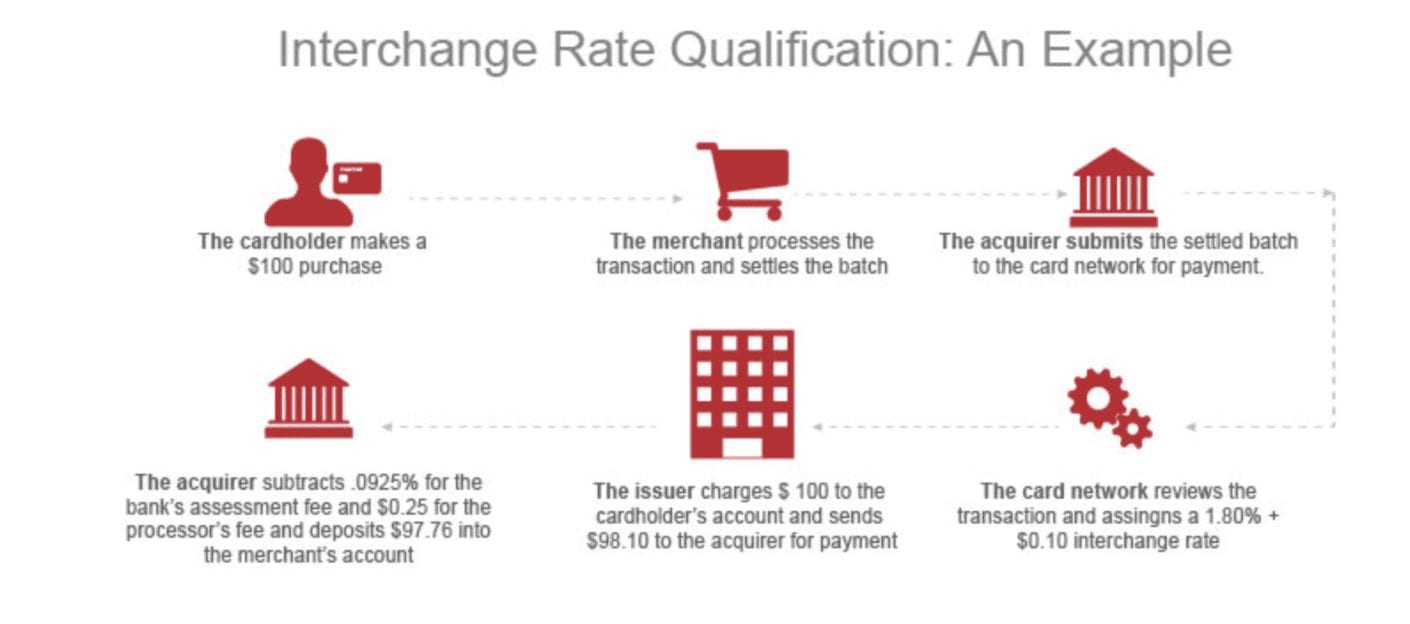

For businesses that process a high volume of transactions, credit card fees can become a significant expense. According to a study by the Federal Reserve, merchants paid an average of 1.53% in processing fees for credit card transactions in 2020. This may seem like a small percentage, but consider this: for a business that processes $1 million in credit card sales annually, that translates to a whopping $15,300 in fees.

Now, let’s take a deeper dive into the various components that make up these fees:

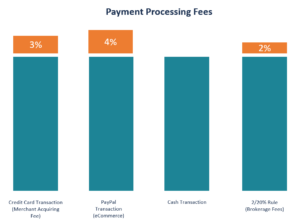

- Interchange fees: These are fees paid by the merchant’s bank to the card-issuing bank. They are typically the largest component of credit card processing fees, ranging from 0.5% to 2.5% of the transaction amount.

- Assessment fees: These are fees charged by the card networks (Visa, MasterCard, American Express, etc.) to process the transaction. They are usually a fixed amount, ranging from a few cents to a few dollars per transaction.

- Gateway fees: These are fees charged by the payment gateway, which is the technology that connects the merchant’s website or POS system to the card network. Gateway fees can vary widely depending on the provider and the level of service offered.

- PCI compliance fees: These are fees charged by the merchant’s bank or a third-party provider to ensure that the business is compliant with the Payment Card Industry Data Security Standard (PCI DSS). PCI compliance is essential for protecting customer data and preventing fraud, but it can also come with a hefty price tag.

The Impact of Credit Card Processing Fees on Businesses

We’ve established that credit card processing fees can be a significant expense for businesses, but how do they impact the bottom line? Well, let’s put it this way: it’s not exactly a positive relationship.

The weight of credit card fees can strain businesses in several ways:

- Reduced profits: As we’ve seen, credit card fees can eat into a business’s profits. This can be especially damaging for small businesses with limited profit margins.

- Increased prices: To offset the cost of credit card fees, some businesses pass them on to their customers in the form of higher prices. This can make it more difficult for customers to afford goods and services, which can ultimately lead to decreased sales.

- Reduced innovation: The burden of credit card fees can stifle innovation by diverting funds away from research and development. This can make it more difficult for businesses to stay competitive in an ever-changing marketplace.

What’s a Business to Do?

Faced with the relentless onslaught of credit card processing fees, businesses are left wondering, “What can we do?” Well, here are a few strategies to mitigate the impact of these fees:

1. Negotiate rates: Don’t be afraid to negotiate with your payment processor for lower rates. By shopping around and comparing different providers, you may be able to secure a more favorable deal.

2. Accept debit cards: Debit card transactions typically have lower processing fees than credit card transactions, so encouraging customers to use debit cards can save you money.

3. Offer discounts for cash payments: If you’re willing to put up with the inconvenience of counting pennies, offering a discount for cash payments can incentivize customers to pay with cash, saving you credit card processing fees.

4. Educate your customers: Many customers are unaware of the fees that businesses incur for processing credit card transactions. By educating your customers about these fees, you may be able to build understanding and encourage them to use alternative payment methods.

Conclusion

Credit card processing fees are an unavoidable reality for businesses in today’s digital age. While they provide convenience for customers and streamline transactions, they also come with a hefty price tag. By understanding the various components of these fees and their impact on the bottom line, businesses can develop strategies to mitigate their impact. Remember, the credit card processing fee sign is not just a warning; it’s an invitation to explore alternatives that can help you keep more of your hard-earned money in your pocket.

Understanding the Different Types of Credit Card Processing Fees

While you may be familiar with the ubiquitous “Credit Card Processing Fee” sign that seems to adorn every checkout counter these days, what exactly are these fees, and who gets them? And more importantly, are they worth it? Credit card processing fees are a complex topic, but we’ll break it down for you so you can make informed decisions about your business.

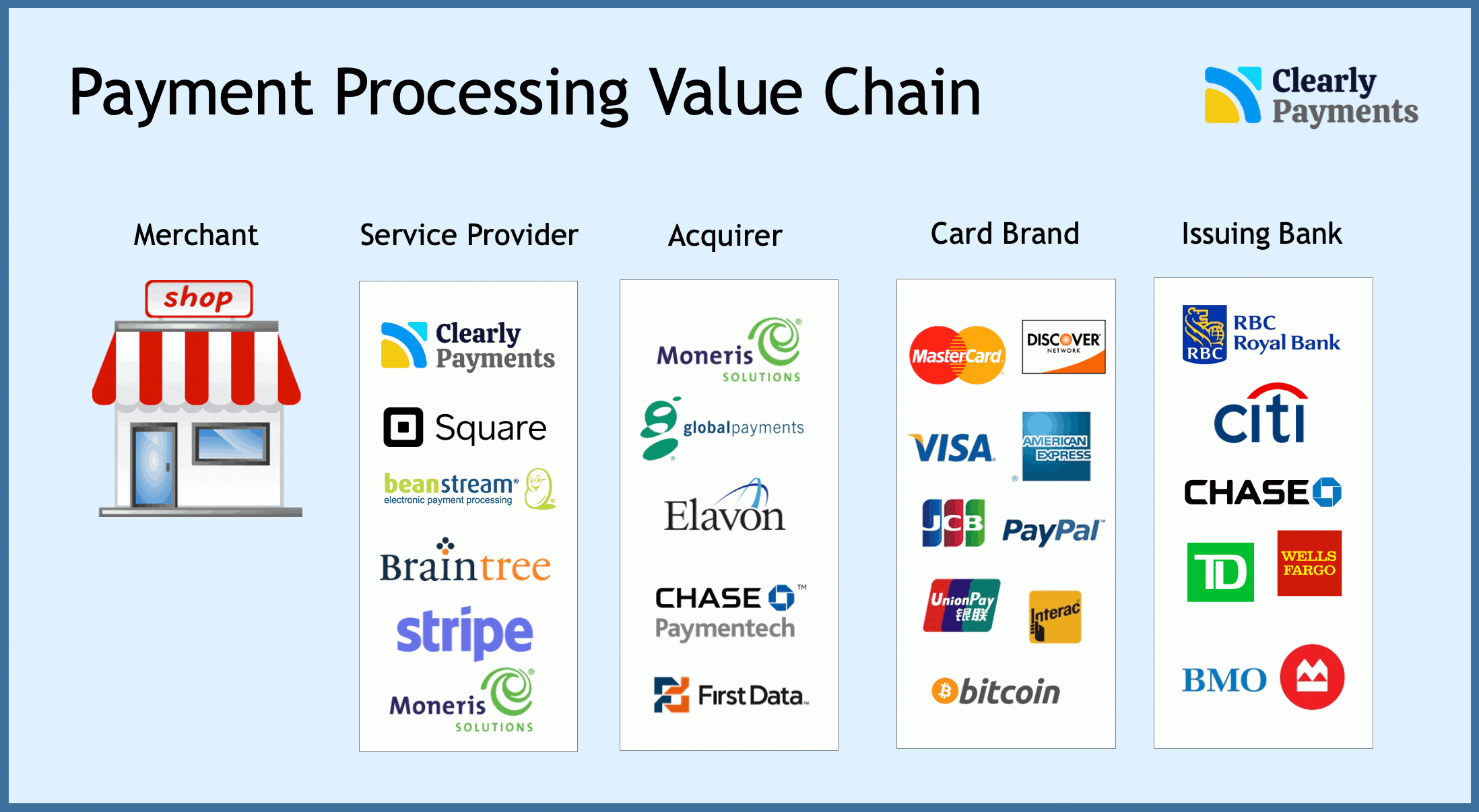

There are three main types of credit card processing fees: interchange fees, network fees, and gateway fees. Interchange fees are the fees that banks charge each other to process a transaction. Network fees are the fees that credit card networks (such as Visa and Mastercard) charge to process a transaction. Gateway fees are the fees that payment gateways (such as PayPal and Stripe) charge to process a transaction.

Interchange fees are the largest component of credit card processing fees. The interchange fee is a percentage of the transaction amount, and it is typically between 1% and 3%. Interchange fees are used to cover the costs of fraud prevention, customer service, and network maintenance.

Network fees are typically a flat fee per transaction. Network fees are used to cover the costs of processing the transaction and providing fraud protection.

Gateway fees are typically a percentage of the transaction amount, and they are typically between 0.25% and 1%. Gateway fees are used to cover the costs of providing a secure payment platform and customer support.

Factors That Affect Credit Card Processing Fees

The amount of credit card processing fees that you pay will depend on a number of factors, including the type of business you have, the type of credit cards you accept, and the volume of transactions you process. Businesses that process a high volume of transactions will typically pay lower credit card processing fees than businesses that process a low volume of transactions. Businesses that accept premium credit cards will typically pay higher credit card processing fees than businesses that accept only non-premium credit cards.

You can reduce your credit card processing fees by negotiating with your payment processor, by accepting only non-premium credit cards, and by processing a high volume of transactions. If you are a small business, you may want to consider using a payment gateway that offers a flat-rate pricing model. Flat-rate pricing models are typically more affordable for small businesses than percentage-based pricing models.

The Pros and Cons of Accepting Credit Cards

Accepting credit cards can have a number of benefits for your business. Credit cards can make it easier for customers to make purchases, which can lead to increased sales. Credit cards can also help you to attract new customers, especially if you offer a rewards program. Additionally, accepting credit cards can help you to build a strong relationship with your customers.

However, there are also some cons to accepting credit cards. Credit card processing fees can be a significant expense for businesses, especially if they process a high volume of transactions. Additionally, accepting credit cards can increase your risk of fraud.

Ultimately, the decision of whether or not to accept credit cards is a business decision that should be made on a case-by-case basis. If you are considering accepting credit cards, it is important to weigh the pros and cons carefully to make sure that it is the right decision for your business.

Credit Card Processing Fee: A Sign of the Times

Well, there it is again: that dreaded little credit card processing fee sign, staring you in the face at checkout. It might be a flat fee, a percentage of your total, or even a combination of both. No matter the shape or size, though, one thing’s for sure: it’s an unwelcome sight for any business. But hey, it’s 2023, right? Cash is so last century. So what’s a business to do besides grin and bear it? Luckily, there are a few tricks up our sleeves to help you reduce those pesky credit card processing fees. Read on, dear reader, and we’ll show you how it’s done.

Negotiate with Your Payment Processor

First things first, let’s talk to the folks who take a cut of every credit card transaction you make: your payment processor. They’re usually the ones who set the fees, so it’s worth giving them a call and seeing if you can negotiate a better deal. Be prepared to provide them with information about your business, such as your monthly sales volume and average transaction size. The more data you can give them, the better your chances of getting a lower rate.

Offer Discounts for Cash Payments

This one’s a bit of a no-brainer, but it’s worth repeating: if you offer a discount for customers who pay with cash, you can incentivize them to do so. This will reduce your overall credit card processing fees, and it might even encourage some customers to switch to cash permanently. Just be sure to make the discount small enough that it doesn’t eat into your profits too much.

Use a Payment Gateway That Offers Competitive Rates

If you’re not happy with the fees your current payment processor is charging you, it might be time to shop around for a new one. There are many different payment gateways out there, each with its own set of fees. Do your research and compare the rates of different gateways before making a decision. You may be able to find a gateway that offers lower fees than your current provider.

Additional Tips for Reducing Credit Card Processing Fees

In addition to the three main strategies we’ve discussed, there are a few other things you can do to further reduce your credit card processing fees:

- Avoid surcharge fees. Some payment processors charge a fee for every transaction that is surcharged (i.e., when you charge the customer a fee for using a credit card). Avoid these fees by setting your prices accordingly.

- Use a payment processor that offers interchange-plus pricing. Interchange-plus pricing is a transparent pricing model that shows you exactly what the payment processor is charging you for each transaction. This can help you avoid hidden fees and ensure that you’re getting the best possible rate.

- Qualify for interchange optimization. Interchange optimization is a program that can help you reduce your interchange fees. To qualify, you must meet certain criteria, such as having a high volume of transactions and a low chargeback rate.

- Use a virtual terminal. A virtual terminal is a software program that allows you to process credit card payments online. Virtual terminals typically have lower fees than traditional payment terminals.

- Outsource your credit card processing. If you don’t have the time or expertise to manage your credit card processing in-house, you can outsource it to a third-party provider. Third-party providers can often get better rates than businesses can on their own.

There you have it, folks! By following these tips, you can reduce your credit card processing fees and keep more of your hard-earned money in your pocket. So next time you see that dreaded fee sign, don’t despair. Just remember, there are plenty of ways to fight back.

Credit Card Processing Fee Sign: A Guide for Businesses and Consumers

In today’s financial landscape, credit cards have become an essential mode of payment, promising convenience and accessibility for both businesses and consumers. However, behind the scenes of every seamless transaction lies a hidden cost: credit card processing fees. These fees, charged by banks and payment processors, can significantly impact the bottom line of businesses and the budgets of consumers.

As a business owner, displaying a credit card processing fee sign is not just a legal requirement, it’s also a transparent way to inform customers of the additional charges associated with using credit cards. By understanding the implications of these fees and communicating them clearly, businesses can maintain trust with their customers and mitigate potential misunderstandings.

For consumers, credit card processing fees can be a hidden expense that can add up over time. By being aware of these fees and considering alternative payment options, consumers can make informed choices and minimize the impact on their wallets.

Types of Credit Card Processing Fees

The world of credit card processing fees is a complex one, with a myriad of charges that can vary depending on the transaction type, payment processor, and card issuer. Some of the most common fees include:

- Interchange Fees: These fees are charged by the card-issuing bank to the merchant’s bank for every transaction.

- Assessment Fees: These fees are charged by credit card networks like Visa and Mastercard to both the issuing bank and the merchant’s bank.

- Processing Fees: These fees are charged by payment processors for handling the transaction.

- Gateway Fees: These fees are charged by payment gateways for providing a secure connection between the merchant’s website and the payment processor.

Impact on Businesses

Credit card processing fees can have a significant impact on businesses, especially those with high transaction volumes. These fees can eat into profit margins and make it challenging to remain competitive. To offset these costs, some businesses may pass on a portion of the fees to their customers in the form of surcharges or increased prices.

Businesses need to carefully consider the implications of credit card processing fees and develop strategies to minimize their impact. This may involve negotiating with payment processors, implementing surcharge programs, or exploring alternative payment options.

The Impact of Credit Card Processing Fees on Consumers

Credit card processing fees can also have an impact on consumers, as businesses may pass on these costs in the form of higher prices. This can be especially burdensome for low-income consumers who rely heavily on credit cards for everyday purchases. Additionally, consumers may incur additional fees if they choose to use their credit cards for cash advances or foreign transactions.

To minimize the impact of credit card processing fees, consumers should be aware of the fees associated with different payment methods and consider using alternative payment options such as debit cards, mobile payments, or cash. They should also be mindful of their spending habits and make an effort to reduce unnecessary credit card usage.

Alternative Payment Options

In addition to credit cards, businesses and consumers have a range of alternative payment options available to them. These options may come with lower fees or other benefits:

- Debit Cards: Debit cards are linked directly to a checking account, eliminating the need for credit. Transactions made with debit cards typically incur lower fees than credit cards.

- Mobile Payments: Mobile payments allow consumers to make purchases using their smartphones. These payments are processed through a mobile wallet app and can be more convenient and secure than traditional credit cards.

- Cash: Cash remains a viable payment option, especially for small transactions or when fees are a concern.

By exploring alternative payment options, businesses and consumers can potentially save money and avoid the complexities associated with credit card processing fees.

Conclusion

Credit card processing fees are a complex and unavoidable part of the modern financial landscape. By understanding the types of fees involved and their impact on both businesses and consumers, we can make informed decisions and develop strategies to minimize their burden. Whether it’s through surcharge programs, alternative payment options, or simply being aware of hidden costs, we can navigate the complexities of credit card processing and ensure that these fees don’t put a damper on our financial well-being.