Here’s Everything You Need To Know About Typical Credit Card Processing Fees

Posted: 02 Apr 2025 on General

What are typical credit card processing fees?

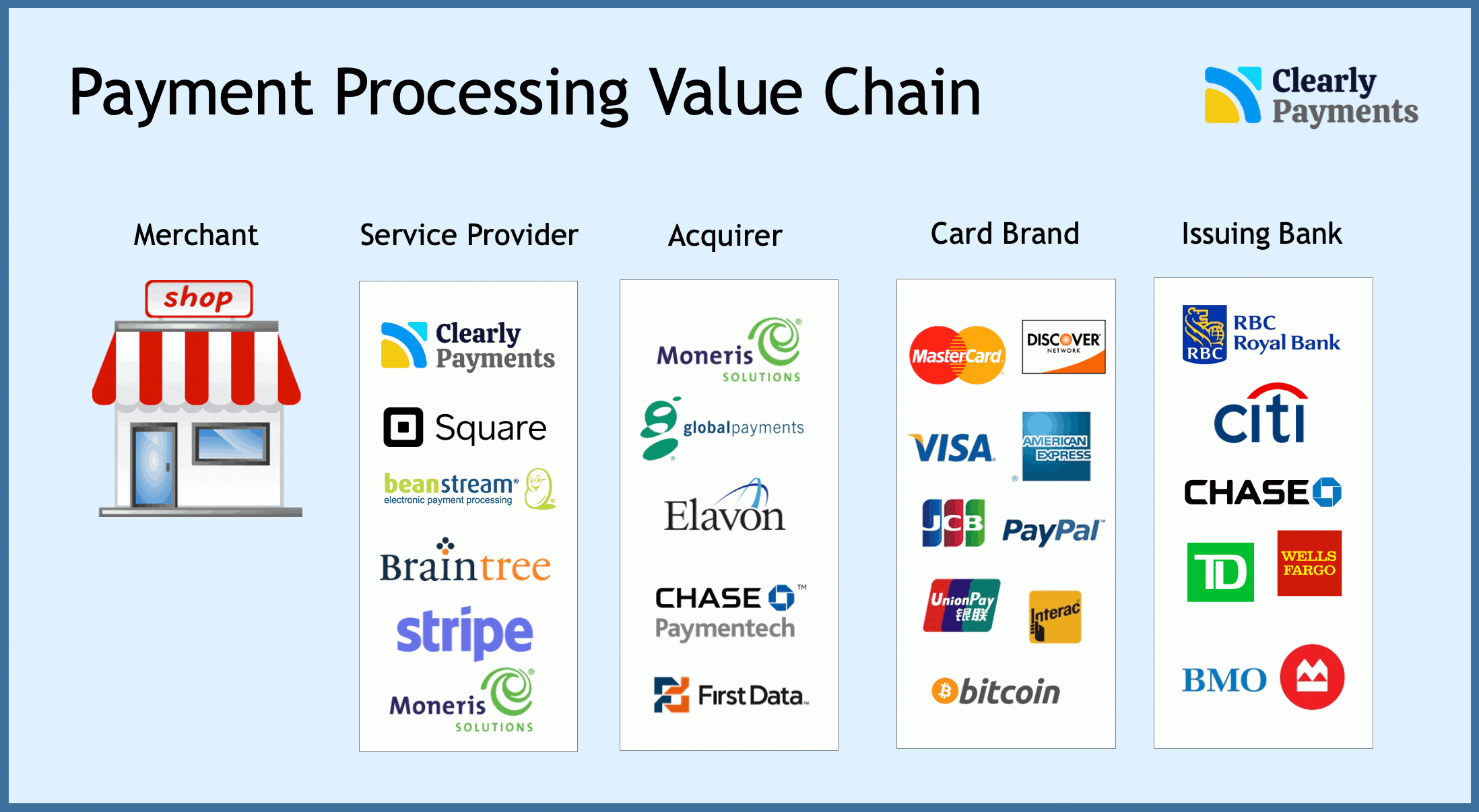

Credit card processing fees, also known as merchant service fees, are charged by payment processors to businesses that accept credit cards as a form of payment. To fully comprehend credit card processing fees, you must first grasp the many players involved in every transaction. When a customer uses a credit card to make a purchase, the transaction passes through a complex network of entities, each of which may charge a fee. These entities include the issuing bank, the acquiring bank, the payment processor, and the credit card network (such as Visa or Mastercard).

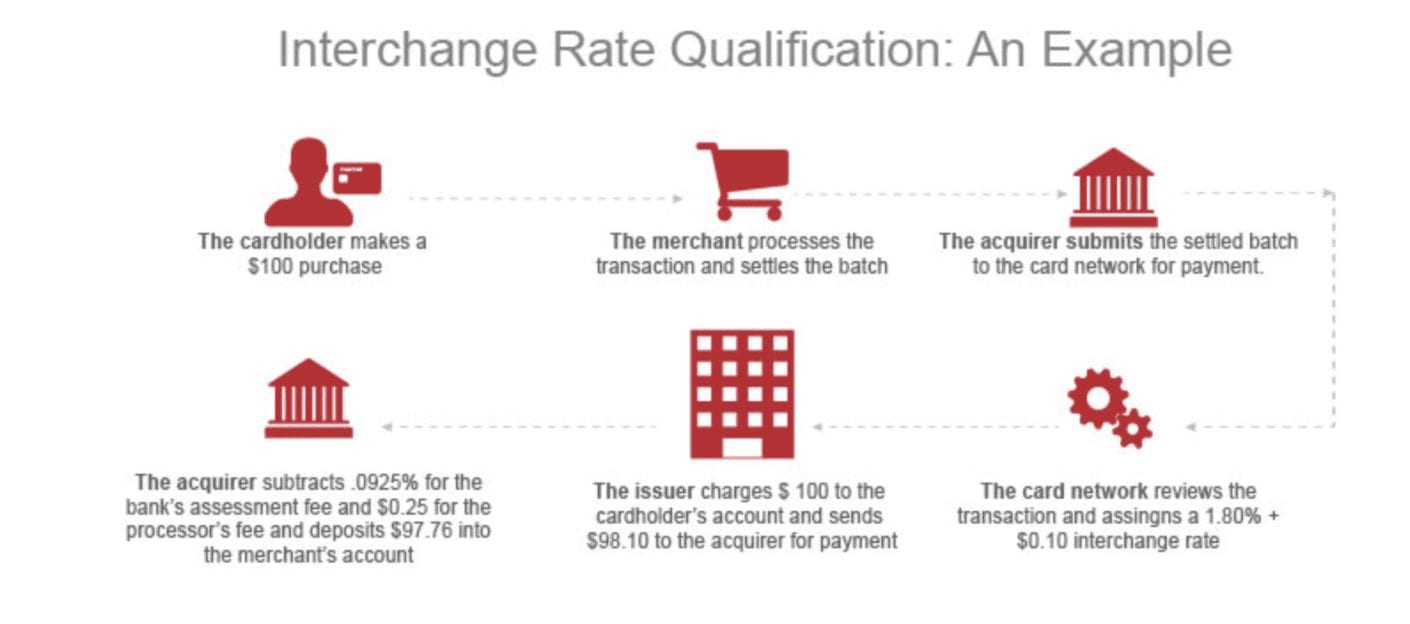

The most frequent credit card processing costs are interchange fees, which are set by the credit card networks and paid by the merchant’s bank to the customer’s bank. The interchange fee is a percentage of the transaction amount, and it varies depending on the type of card used (such as credit, debit, or prepaid) and the type of transaction (such as in-person, online, or over the phone).

In addition to interchange fees, payment processors may also charge a variety of other fees, such as:

- Transaction fees: A flat fee charged for each transaction, regardless of the amount.

- Discount rates: A percentage of the transaction amount charged by the payment processor.

- Gateway fees: A fee charged by the payment gateway, which is the software that connects the merchant’s website to the payment processor.

- PCI compliance fees: Fees charged by the payment processor to help merchants maintain compliance with the Payment Card Industry Data Security Standard (PCI DSS).

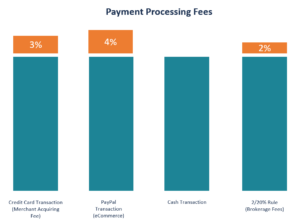

The total cost of credit card processing can vary significantly depending on the type of business, the volume of transactions, and the payment processor used. However, as a general rule, businesses can expect to pay between 2% and 4% of the transaction amount in credit card processing fees.

How can businesses reduce credit card processing fees?

There are a number of strategies that businesses can use to reduce credit card processing fees, such as:

- Negotiating with payment processors: Businesses can negotiate with payment processors to get lower rates and fees.

- Using a payment gateway that offers competitive rates: Payment gateways vary in the fees they charge, so it’s important to compare rates before choosing a gateway.

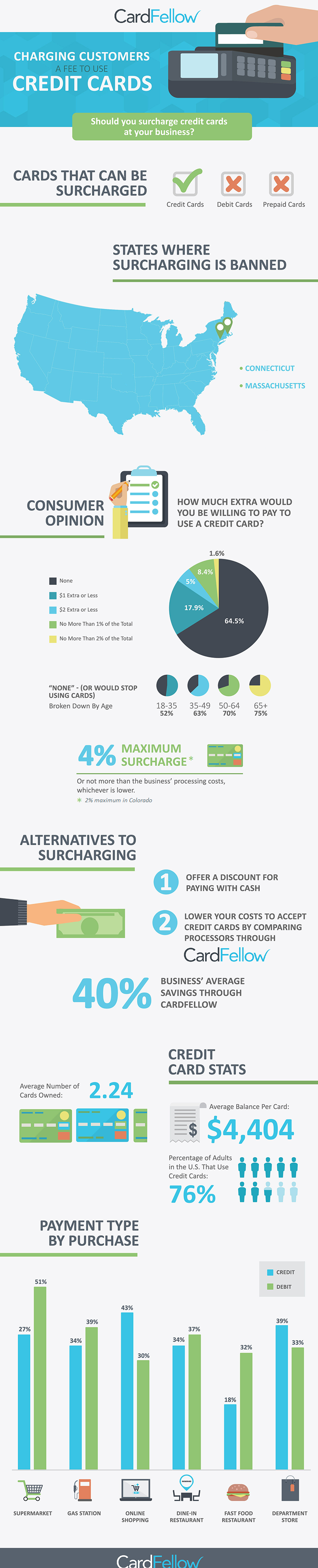

- Passing the fees on to customers: Some businesses choose to pass the cost of credit card processing fees on to their customers by adding a surcharge to the total amount of the purchase.

- Offering discounts for cash payments: Businesses can encourage customers to pay with cash by offering discounts for doing so.

What are the pros and cons of accepting credit cards?

There are a number of pros and cons to accepting credit cards as a form of payment.

Pros

- Convenience: Credit cards are a convenient way for customers to pay for goods and services.

- Increased sales: Accepting credit cards can help businesses increase sales by making it easier for customers to make purchases.

- Improved customer satisfaction: Customers appreciate the convenience of being able to use credit cards, and they may be more likely to do business with businesses that accept credit cards.

Cons

- Cost: Credit card processing fees can be a significant expense for businesses.

- Fraud: Credit card fraud is a risk for businesses that accept credit cards.

- Security: Businesses that accept credit cards need to take steps to protect customer data from theft and fraud.

Ultimately, the decision of whether or not to accept credit cards is a complex one that depends on a number of factors. Businesses should carefully consider the pros and cons before making a decision.

Credit Card Processing Fees: The Ultimate Guide

Every business owner knows that accepting credit cards is a must in today’s market. But what many business owners don’t realize is that there are fees associated with processing credit cards. These fees can add up quickly, so it’s important to understand what they are and how to minimize them.

Typical Credit Card Processing Fees

The average credit card processing fee is around 2.9% of the transaction amount, but it can vary depending on the type of card, the card issuer, and the payment processor. For example, processing a Visa card will typically cost more than processing a Mastercard, and processing a debit card will typically cost less than processing a credit card.

Types of Credit Card Processing Fees

There are two main types of credit card processing fees: interchange fees and transaction fees.

Interchange Fees

Interchange fees are the fees that banks charge each other to process credit card transactions. These fees are typically passed on to merchants in the form of higher processing fees. The interchange fee varies depending on the type of card, the card issuer, and the transaction amount. For example, the interchange fee for a Visa card is typically higher than the interchange fee for a Mastercard.

Transaction Fees

Transaction fees are the fees that payment processors charge merchants to process credit card transactions. These fees typically range from $0.05 to $0.25 per transaction. Some payment processors also charge a monthly fee, regardless of the number of transactions processed.

Minimizing Credit Card Processing Fees

There are a few things you can do to minimize credit card processing fees:

- Negotiate with your payment processor. Many payment processors are willing to negotiate their fees. So, it’s worth it to call around and compare rates before you choose a processor.

- Use a payment processor that offers interchange-plus pricing. Interchange-plus pricing means that the payment processor will pass on the interchange fee to you, plus a small markup. This can save you money compared to processors that charge a flat fee.

- Encourage customers to use debit cards. Debit cards typically have lower interchange fees than credit cards. So, you can save money by encouraging customers to use debit cards whenever possible.

- Offer discounts for cash payments. Offering discounts for cash payments can encourage customers to pay with cash, which will save you money on processing fees.

Conclusion

Credit card processing fees are a cost of doing business, but there are things you can do to minimize them. By understanding the different types of fees and negotiating with your payment processor, you can save money on credit card processing and keep more of your hard-earned profits.

Typical Credit Card Processing Fees

Credit card processing fees are fees businesses must pay to accept credit card payments. These fees can vary widely, depending on the size of the business, the type of cards accepted, and the payment processor used. However, the average credit card processing fee is around 2-3%.

How Are Credit Card Processing Fees Calculated?

There are two main types of credit card processing fees: interchange fees and transaction fees.

-

Interchange fees are set by the card networks (Visa, Mastercard, American Express, and Discover) and are based on the type of card used, the amount of the transaction, and the merchant’s industry.

-

Transaction fees are charged by the payment processor and can vary depending on the processor and the merchant’s account type.

The interchange fee is typically the largest component of credit card processing fees. For example, a typical interchange fee for a Visa credit card is around 1.5%. This means that on a $100 purchase, the merchant would pay $1.50 in interchange fees.

The transaction fee is typically a flat fee charged by the payment processor. For example, a typical transaction fee is around $0.10. This means that on a $100 purchase, the merchant would pay $0.10 in transaction fees.

Factors That Affect Credit Card Processing Fees

There are a number of factors that can affect credit card processing fees, including:

- The type of card used. Credit cards with higher rewards rates typically have higher interchange fees.

- The amount of the transaction. Interchange fees are typically a percentage of the transaction amount.

- The merchant’s industry. Merchants in high-risk industries, such as gambling and online gaming, typically have higher interchange fees.

- The payment processor. Different payment processors charge different transaction fees.

How to Reduce Credit Card Processing Fees

There are a number of ways to reduce credit card processing fees, including:

- Negotiating with your payment processor. You can often negotiate a lower transaction fee with your payment processor.

- Offering discounts for cash payments. This can encourage customers to pay with cash, which will reduce your credit card processing fees.

- Using a payment gateway. A payment gateway can help you to compare rates from different payment processors and find the best deal.

Conclusion

Credit card processing fees can be a significant expense for businesses. However, there are a number of ways to reduce these fees. By understanding how credit card processing fees are calculated and the factors that affect them, you can make informed decisions about how to accept credit card payments.

Typical Credit Card Processing Fees

Okay, so you need to take plastic. Unfortunately, there’s no way around it in today’s business world. Credit cards are pretty much the universal form of payment, both in brick-and-mortar stores and online. But accepting credit cards comes with a cost. Credit card processing fees, also known as merchant fees, can eat into your profits if you’re not careful.

The typical credit card processing fee is around 2-3%. That doesn’t sound like much. But it can add up quickly, especially if you’re a high-volume merchant. For example, if you process $1 million in credit card sales annually, you could be paying $20,000-$30,000 in processing fees.

Credit card processing fees are typically made up of three components:

-

Interchange fees: These are the fees that banks charge merchants to process credit card transactions. They are the largest component of credit card processing fees.

-

Assessment fees: These are the fees that credit card networks charge merchants to use their networks. They are a smaller component of credit card processing fees than interchange fees.

-

Processor fees: These are the fees that payment processors charge merchants for their services. They are the smallest component of credit card processing fees.

How to Reduce Credit Card Processing Fees

There are a number of ways to reduce credit card processing fees, including negotiating with your payment processor, using a payment gateway that offers low fees, and passing on the fees to your customers.

1. Negotiate with Your Payment Processor

The first step to reducing credit card processing fees is to negotiate with your payment processor. Payment processors are the companies that handle the technical side of credit card processing. They are responsible for authorizing and settling transactions, and they provide you with the equipment and software you need to accept credit cards.

When you’re negotiating with your payment processor, you can ask for lower interchange fees, assessment fees, and processor fees. You can also ask for discounts for high-volume processing or for bundled services.

2. Use a Payment Gateway That Offers Low Fees

Another way to reduce credit card processing fees is to use a payment gateway that offers low fees. Payment gateways are the middlemen between your website and your payment processor. They handle the secure transmission of credit card data and they provide you with a variety of features, such as fraud protection and recurring billing.

When choosing a payment gateway, it’s important to compare the fees that they charge. Some payment gateways charge a flat fee per transaction, while others charge a percentage of the transaction amount. You’ll also want to consider the features that each payment gateway offers and the level of customer support that they provide.

3. Pass On the Fees to Your Customers

If you’re unable to negotiate lower credit card processing fees with your payment processor or find a payment gateway that offers lower fees, you may want to consider passing on the fees to your customers. Passing on the fees is a controversial practice, but it can be a way to reduce your costs.

If you decide to pass on the fees to your customers, you need to be transparent about it. You should inform your customers of the fees and give them the option to pay with a different method of payment.

Conclusion

Credit card processing fees are a cost of doing business. But there are a number of ways to reduce these fees. By negotiating with your payment processor, using a payment gateway that offers low fees, or passing on the fees to your customers, you can save money.

Even if you can’t avoid paying credit card processing fees altogether, you can take steps to reduce them. By following the tips in this article are you sure to save money.