How Much Is The Credit Card Processing Fees

Posted: 02 Apr 2025 on General

Introduction

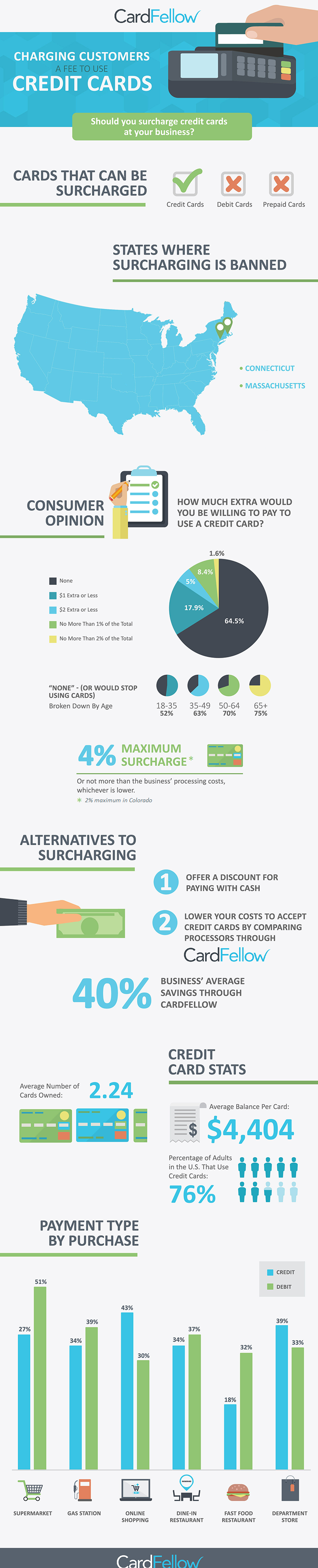

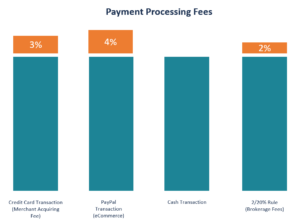

Credit card processing fees can be a significant expense for businesses. So, how much are credit card processing fees, exactly? The answer depends on several factors, but the average fee is around 2% to 3% of each transaction. This fee is typically paid by the merchant, not the customer. So, if you’re a business, it’s important to factor these fees into your pricing. Otherwise, you could end up losing money on each transaction.

Factors that affect credit card processing fees

Several factors can affect credit card processing fees, including:

- The type of card. Credit cards are classified as either “consumer” or “commercial.” Consumer cards are used by individuals for personal purchases, while commercial cards are used by businesses for business-related purchases. Commercial cards typically have higher fees than consumer cards.

- The payment method. Credit cards can be used for in-person transactions, online transactions, or over the phone. In-person transactions have the lowest fees, followed by online transactions and then phone transactions.

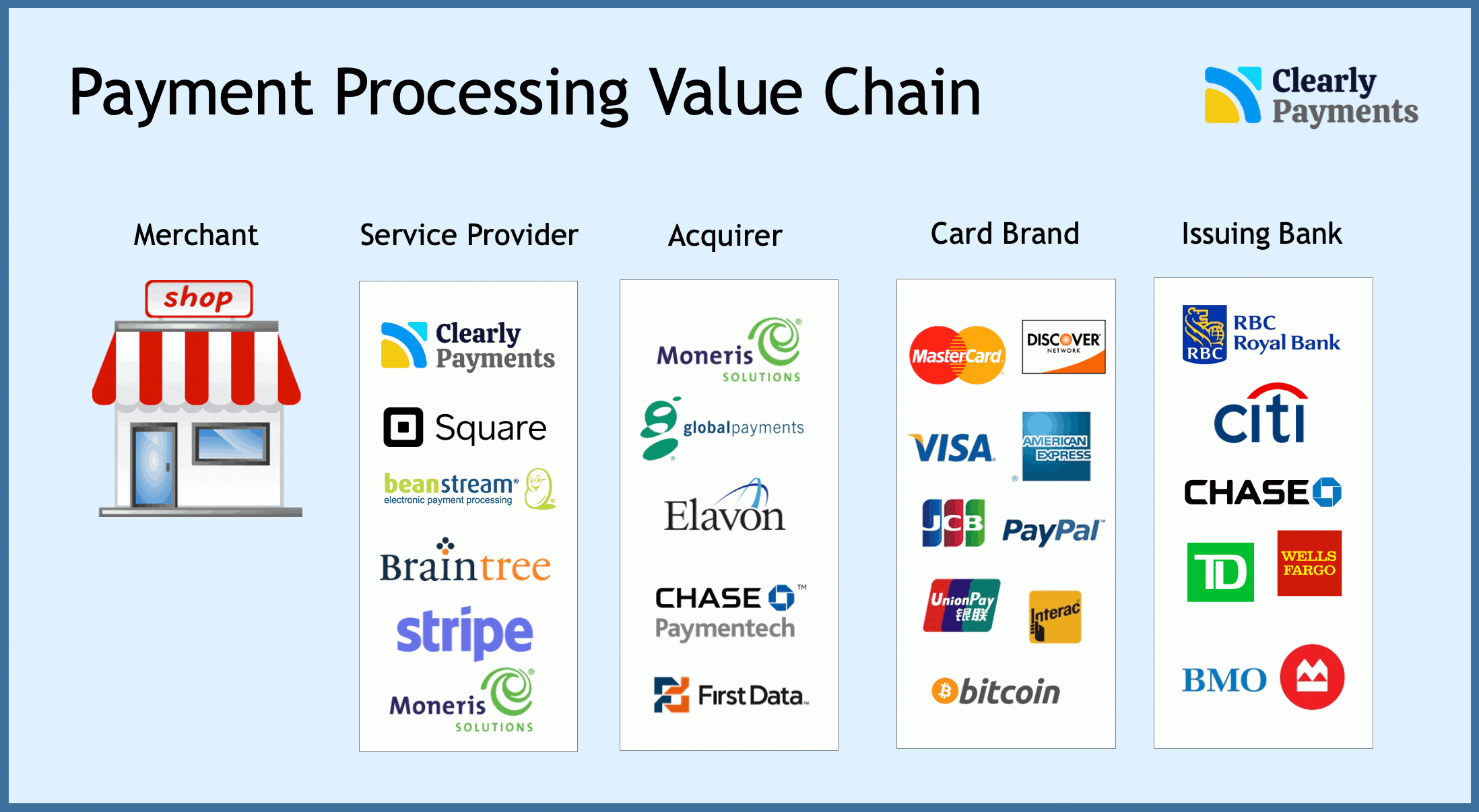

- The card issuer. Different card issuers have different fee structures. Some issuers have higher fees than others. It’s important to compare the fees of different issuers before choosing one for your business.

- The volume of transactions. Businesses that process a high volume of transactions can often negotiate lower fees with their credit card processor.

How to reduce credit card processing fees

There are several things that businesses can do to reduce credit card processing fees, including:

- Negotiate with your credit card processor. Businesses that process a high volume of transactions can often negotiate lower fees with their credit card processor.

- Choose a credit card processor that offers low fees. There are several credit card processors that offer low fees. It’s important to compare the fees of different processors before choosing one for your business.

- Use a payment gateway that offers low fees. A payment gateway is a service that allows businesses to accept credit card payments online. Some payment gateways offer lower fees than others. It’s important to compare the fees of different payment gateways before choosing one for your business.

- Encourage customers to use debit cards or cash. Debit cards and cash have lower processing fees than credit cards. By encouraging customers to use these payment methods, businesses can reduce their overall credit card processing fees.

Alternatives to credit card processing

For businesses that process a low volume of transactions, there are several alternatives to credit card processing. These alternatives include:

- PayPal. PayPal is a popular online payment service that allows businesses to accept payments from customers via PayPal accounts, debit cards, or credit cards. PayPal fees are typically lower than credit card processing fees.

- Venmo. Venmo is a mobile payment service that allows businesses to accept payments from customers via Venmo accounts or debit cards. Venmo fees are typically lower than credit card processing fees.

- Cash. Cash is a traditional payment method that has no processing fees. However, cash can be inconvenient and risky for businesses.

How Much Are Credit Card Processing Fees?

Credit card processing fees, also known as payment processing fees, are the charges merchants pay to accept credit card payments. These fees can vary widely depending on a number of factors, including the type of credit card, the amount of the transaction, and the merchant’s processing agreement. In general, credit card processing fees range from 1% to 3% of the transaction amount.

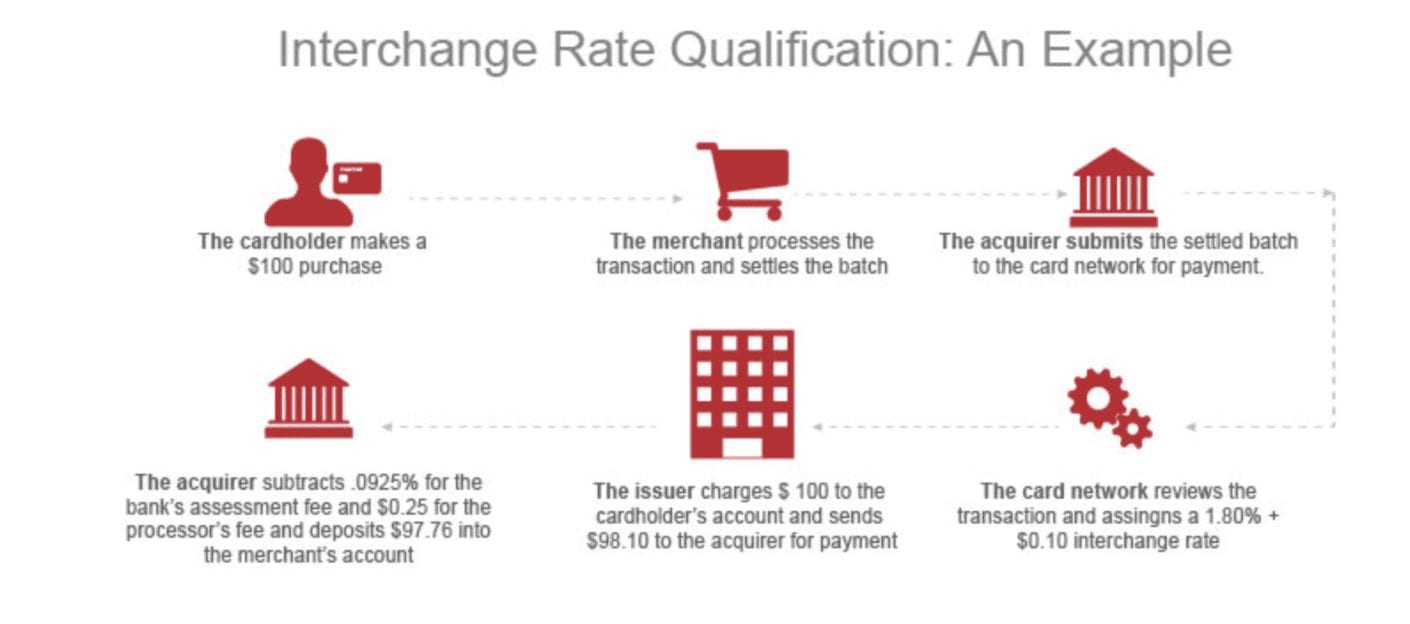

Factors Affecting Fees

The interchange fee, which is a fee charged by the card issuer to the merchant, is a major factor in determining processing fees. Interchange fees are typically set by the card networks (Visa, Mastercard, etc.) and vary depending on the type of card and the merchant category. For example, interchange fees for premium cards, such as rewards cards, are typically higher than interchange fees for standard cards. Similarly, interchange fees for merchants in high-risk categories, such as online gambling or adult entertainment, are typically higher than interchange fees for merchants in low-risk categories.

In addition to the interchange fee, other factors that can affect credit card processing fees include:

- Discount rate: This is the percentage of the transaction amount that the merchant’s payment processor charges. Discount rates can vary depending on the processor and the merchant’s processing volume.

- Monthly fees: Some payment processors charge a monthly fee, regardless of the number of transactions processed.

- PCI compliance fees: Merchants that accept credit cards must comply with the Payment Card Industry Data Security Standard (PCI DSS). Some payment processors charge a fee to help merchants with PCI compliance.

- Chargeback fees: Merchants may be charged a fee if a customer disputes a transaction and the chargeback is processed.

How to Reduce Credit Card Processing Fees

There are a number of things merchants can do to reduce credit card processing fees, including:

- Negotiate with your payment processor: Merchants can negotiate with their payment processor to get a lower discount rate or monthly fee.

- Increase your processing volume: Merchants that process a high volume of transactions may be eligible for lower interchange fees.

- Accept more low-cost payment options: Merchants can reduce their overall processing costs by accepting more low-cost payment options, such as debit cards or ACH transfers.

- Use a payment gateway that offers interchange optimization: Some payment gateways offer interchange optimization services that can help merchants reduce their interchange fees.

Conclusion

Credit card processing fees can be a significant expense for merchants. However, by understanding the factors that affect these fees and by taking steps to reduce them, merchants can save money and improve their bottom line.

How Much Are Credit Card Processing Fees?

When you swipe your plastic, you’re not just paying for the goods or services you’re buying. You’re also paying a hidden fee that goes to the credit card processing company. These fees can add up, especially if you’re a business that accepts a lot of credit cards.

How Much Are Credit Card Processing Fees?

The average credit card processing fee is around 2-3%. This means that for every $100 you spend using a credit card, you’re paying $2-$3 in fees. These fees may vary depending on the type of card you use, the merchant you’re buying from, and the processing company you use.

Impact on Businesses

Credit card processing fees can impact businesses by reducing their profit margins and increasing their operating costs. Businesses that accept a lot of credit cards may find that their processing fees eat into their profits. This can be especially true for small businesses that operate on thin margins.

-

Reduced Profit Margins: Credit card processing fees can reduce a business’s profit margins by eating into the money they make on each sale. For example, if a business sells a product for $100 and the credit card processing fee is 3%, the business will only make $97.

-

Increased Operating Costs: Credit card processing fees can also increase a business’s operating costs. This is because businesses often have to pay a monthly fee to their processing company, as well as per-transaction fees. These fees can add up, especially for businesses that process a lot of transactions.

How to Reduce Credit Card Processing Fees

There are a few things businesses can do to reduce their credit card processing fees:

-

Negotiate with Your Processor: Businesses can negotiate with their processing company to get a lower rate. This is especially possible if you’re a large business that processes a lot of transactions.

-

Shop Around: There are many different credit card processing companies out there. Businesses can shop around to find a company that offers the lowest rates.

-

Use a Payment Gateway: A payment gateway can help businesses reduce their credit card processing fees by aggregating transactions and negotiating lower rates with processing companies.

Conclusion

Credit card processing fees are a hidden cost that can impact businesses by reducing their profit margins and increasing their operating costs. Businesses should be aware of these fees and take steps to reduce them whenever possible.

Credit Card Processing Fees: What’s the Damage?

If you accept credit cards at your business, you know that there’s a cost associated with it. Credit card processing fees can eat into your profits, so it’s important to understand how they work and how to minimize them.

How much are the credit card processing fees?

Credit card processing fees vary depending on a number of factors, including the type of card, the amount of the transaction, and the merchant service provider. Generally speaking, you can expect to pay between 1.5% and 3.5% of the transaction amount.

Types of Credit Card Processing Fees

There are two main types of credit card processing fees: interchange fees and transaction fees.

**Interchange fees** are set by the credit card companies and are paid by the merchant to the card-issuing bank. These fees vary depending on the type of card and the amount of the transaction.

**Transaction fees** are charged by the merchant service provider for processing the transaction. These fees typically range from 0.10% to 0.25% of the transaction amount.

Minimizing Fees

Businesses can take steps to minimize credit card processing fees by negotiating with their merchant service provider, choosing cards with lower interchange fees, and implementing fraud prevention measures.

1. Negotiate with Your Merchant Service Provider

The first step to minimizing credit card processing fees is to negotiate with your merchant service provider. You may be able to get a lower rate if you agree to a longer contract or if you process a higher volume of transactions.

2. Choose Cards with Lower Interchange Fees

The interchange fee is the biggest component of credit card processing fees. You can save money by choosing cards with lower interchange fees. For example, Visa and Mastercard have lower interchange fees than American Express and Discover.

3. Implement Fraud Prevention Measures

Fraudulent transactions can cost you money in chargebacks. Chargebacks occur when a customer disputes a transaction and the bank reverses the charges. You can reduce your risk of chargebacks by implementing fraud prevention measures, such as using address verification and CVV codes.

Other Ways to Save Money on Credit Card Processing

In addition to the tips above, there are a few other ways to save money on credit card processing:

Consider using a payment gateway that offers flat-rate pricing. This can be a good option for businesses that process a high volume of transactions.

Offer discounts for customers who pay with cash or check. This can encourage customers to use alternative payment methods that don’t incur credit card processing fees.

Pass the credit card processing fees on to your customers. This is a controversial practice, but it can be a way to offset the cost of accepting credit cards.

Conclusion

Credit card processing fees are a cost of doing business, but there are steps you can take to minimize them. By negotiating with your merchant service provider, choosing cards with lower interchange fees, and implementing fraud prevention measures, you can save money on credit card processing and keep more of your profits.