How To Avoid Credit Card Processing Fees

Posted: 02 Apr 2025 on General

Introduction

Is your business drowning in credit card processing fees?

Whether you’re a seasoned entrepreneur or just starting out, these pesky charges can put a major dent in your bottom line. But what if there was a way to avoid them altogether?

Believe it or not, it’s possible to keep more of your hard-earned cash by implementing a few clever strategies. In this comprehensive guide, we’ll dive into the nitty-gritty of credit card processing fees and show you how to steer clear of them like a pro. Get ready to optimize your business and watch those savings soar!

Negotiating with Your Processor

Negotiating with your credit card processor might feel like a daunting task, but it’s worth the effort. Similar to haggling over a car price, you can often secure reduced fees or even eliminate them altogether by simply asking. Keep in mind that larger businesses typically have more negotiating power, but don’t let that discourage you if you’re a smaller operation. Remember, every penny saved counts!

Before you pick up the phone, do your research. Compare fees from different processors and be prepared to switch if you find a better deal. Confidence is key, so be assertive and don’t be afraid to ask for what you want. Remember, the worst they can say is no. And if that happens, don’t get discouraged – there are plenty of other processors out there willing to work with you.

Here are some tips for negotiating with your credit card processor:

- Gather your data. Before you start negotiating, take some time to gather data on your credit card processing fees. This will give you a good starting point for your negotiations.

- Be prepared to walk away. If you’re not happy with the fees that your processor is offering, be prepared to walk away. There are plenty of other processors out there who would be happy to work with you.

- Don’t be afraid to negotiate. Credit card processing fees are negotiable. Don’t be afraid to ask for a lower rate or even a waiver of fees.

Optimizing Your Processing Volume

If you want to avoid credit card processing fees, one of the best things you can do is to optimize your processing volume. This means taking steps to reduce the number of transactions you process, as well as the average amount of each transaction.

One way to reduce the number of transactions you process is to offer discounts for customers who pay with cash or check. You can also encourage customers to make larger purchases less frequently.

To reduce the average amount of each transaction, you can offer tiered pricing or bundle products and services together.

By optimizing your processing volume, you can significantly reduce your credit card processing fees.Choosing the Right Payment Processor

When it comes to avoiding credit card processing fees, choosing the right payment processor is key.

There are a number of different payment processors out there, each with its own set of fees.

It’s important to compare the fees of different processors before you choose one.

You should also consider the features that each processor offers.

Some processors offer features that can help you reduce your processing fees.

For example, some processors offer volume discounts or allow you to negotiate your fees.

When choosing a payment processor, it’s important to consider the following factors:- Fees: The fees that a payment processor charges are one of the most important factors to consider. Make sure to compare the fees of different processors before you choose one.

- Features: The features that a payment processor offers are another important factor to consider. Some processors offer features that can help you reduce your processing fees.

- Customer service: The customer service that a payment processor provides is another important factor to consider. Make sure to choose a processor that offers good customer service.

By following these tips, you can avoid credit card processing fees and save money on your business transactions.

How to Dodge the Hidden Credit Card Processing Fee Trap

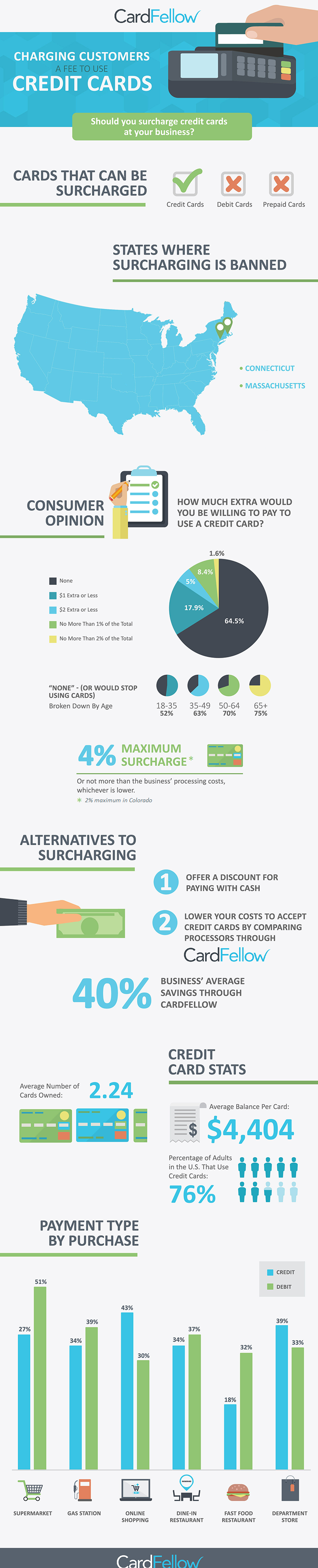

Credit cards are a prevalent part of our lives. We use them to buy groceries, gas, and even our morning coffee. But did you know that every time you swipe your card, you’re likely paying a hidden fee? These fees, known as credit card processing fees, can add up quickly, especially if you’re a small business owner. In this article, we’ll take a deep dive into the world of credit card processing fees and arm you with tips on how to avoid them or at least, minimize their impact on your bottom line.

Understanding Credit Card Processing Fees

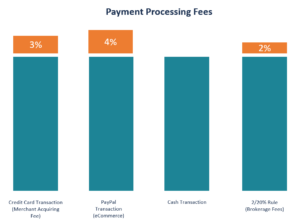

Credit card processing fees are charged by credit card companies to businesses for each transaction that is processed. These fees can range from 1.5% to 3.5%, but they can vary depending on the type of card being used, the volume of transactions being processed, and the merchant’s relationship with the credit card company.

The Anatomy of a Credit Card Processing Fee

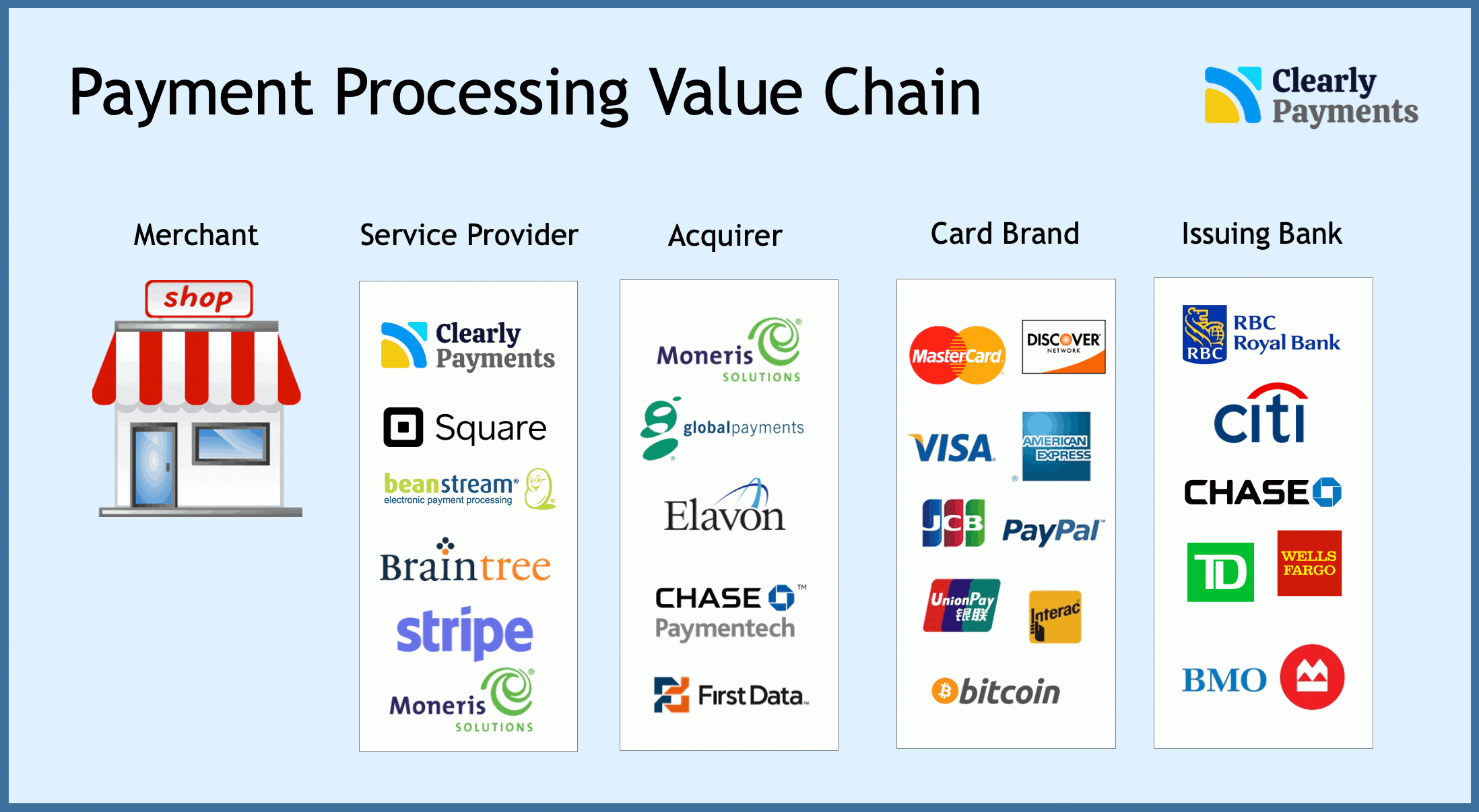

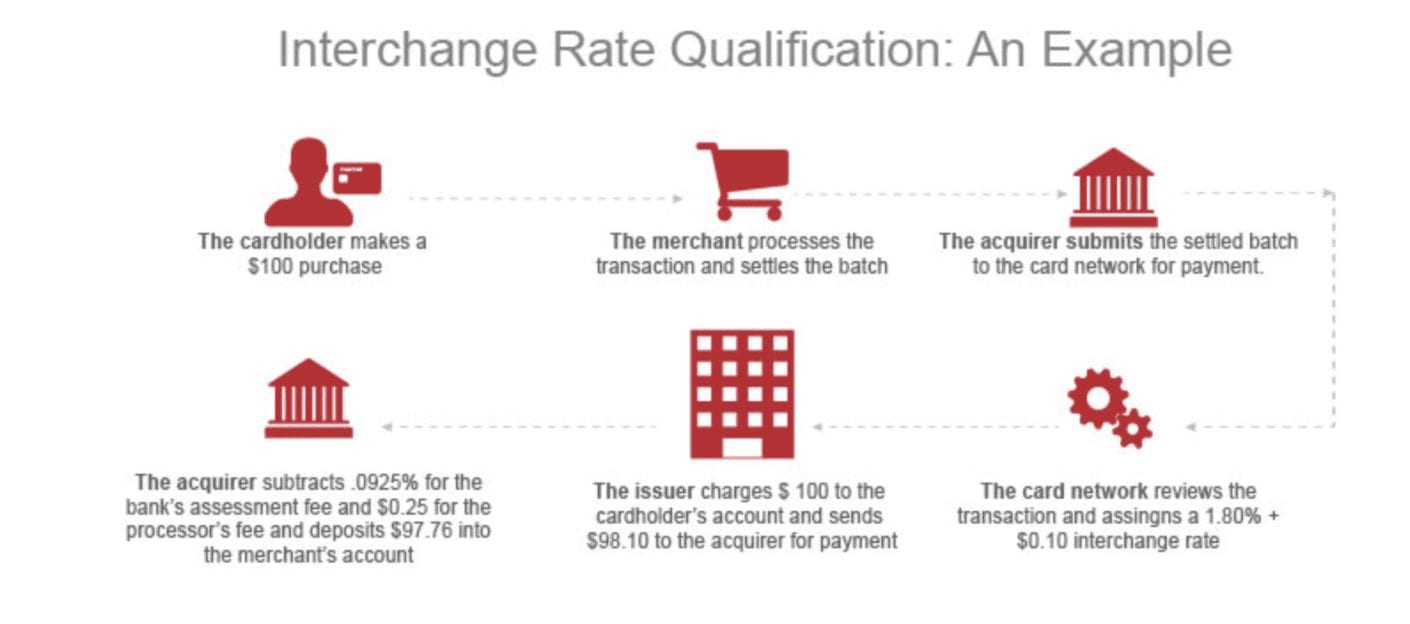

To fully grasp the ins and outs of credit card processing fees, we need to dissect their intricate anatomy. These fees typically comprise two main components: interchange fees and network fees. Interchange fees are paid by the merchant’s bank to the card-issuing bank, while network fees are paid to the credit card network, such as Visa or Mastercard. Additionally, some processors may impose a markup on these fees, further increasing the cost to the merchant. P>

The Impact of Credit Card Processing Fees

Credit card processing fees can have a significant impact on a business’s bottom line. They can reduce profit margins, especially for small businesses that operate on tight margins. Additionally, these fees can be a deterrent for customers who prefer to use credit cards, as they may be reluctant to make purchases that carry additional charges. P>

Avoiding Credit Card Processing Fees

Now that we’ve shed light on the nature of credit card processing fees, let’s shift our focus to strategies for minimizing their impact. While it may not be entirely possible to eliminate these fees altogether, there are several effective ways to reduce their burden.

Negotiate with Your Processor

Just like haggling over the price of a car, you can negotiate with your credit card processor to secure a more favorable rate. By presenting your transaction volume and demonstrating your business’s value, you may be able to negotiate a lower fee. It’s worth noting that larger businesses with higher transaction volumes typically have more bargaining power.

Choose the Right Processor

Not all credit card processors are created equal. Some processors have higher fees than others, and some offer features that can help you save money. When choosing a processor, be sure to compare fees, features, and customer service. You may also want to consider using a payment gateway that offers multiple processing options, allowing you to choose the most cost-effective option for each transaction.

Use a Credit Card with Rewards

If you’re a frequent credit card user, consider using a card that offers rewards for business purchases. These rewards can offset the cost of credit card processing fees, effectively reducing their impact on your bottom line. However, it’s important to factor in the annual fee and other associated costs of the rewards card to ensure that the benefits outweigh the drawbacks.

Offer Alternative Payment Options

Providing alternative payment options, such as cash or debit cards, can help you avoid credit card processing fees altogether. Debit card transactions typically have lower fees than credit card transactions, and cash transactions don’t incur any fees at all. By offering multiple payment options, you can cater to customers who prefer to use different methods and minimize your processing costs.

Educate Your Customers

Transparency is key when it comes to credit card processing fees. By educating your customers about these fees and explaining why you need to charge them, you can reduce customer dissatisfaction and build trust. You can display signage at your checkout counters, include a notice on your invoices, or create a dedicated page on your website to inform customers about your credit card policies. Empowering customers with knowledge can help foster understanding and minimize any potential backlash.

How to Avoid Credit Card Processing Fees and Save Your Business Money

In today’s digital age, credit cards have become an indispensable tool for businesses of all sizes. They offer customers a convenient way to pay for goods and services, and they can help businesses increase their sales. However, credit card processing fees can eat into your profits, so it’s important to find ways to avoid them whenever possible. Here are a few tips:

Negotiate Lower Rates

The first step is to negotiate lower rates with your credit card processor. Many processors are willing to work with businesses to find a rate that works for both parties. To get the best deal, it’s important to shop around and compare rates from different processors. You should also be prepared to provide your processor with information about your business, such as your average monthly sales volume and the types of cards you accept.

Opt for Alternative Payment Methods

Another way to avoid credit card processing fees is to offer alternative payment methods to your customers. These methods may include cash, checks, debit cards, or even online payment services like PayPal. While these methods may not be as convenient as credit cards, they can help you save money on fees.

Adjust Your Pricing

If you can’t avoid credit card processing fees altogether, you may want to consider adjusting your pricing to offset the cost. For example, you could increase your prices slightly to cover the cost of the fees. Or, you could offer a discount to customers who pay with cash or check. This way, you can still accept credit cards without sacrificing your profit margin.

Credit card processing fees are a fact of life for businesses that accept credit cards. However, there are a number of things you can do to minimize or eliminate these fees. By following the tips above, you can save your business money and keep your profits healthy.

In addition to the methods listed above, there are a few other things you can do to avoid credit card processing fees:

- Use a payment processor that offers a low flat rate. This type of processor charges a fixed fee per transaction, regardless of the amount of the transaction.

- Use a processor that offers interchange-plus pricing. This type of pricing allows you to pay the interchange fee plus a markup. The interchange fee is the fee that the credit card companies charge the processor. The markup is the fee that the processor charges you.

- Use a payment gateway that allows you to pass on the processing fees to your customers. This option is not available with all payment gateways, but it can help you avoid paying the fees yourself.

- Increased profitability: Lower processing fees mean more money in your pocket, allowing you to invest in growth initiatives, hire additional staff, or reward your team.

- Improved cash flow: When you save on processing fees, you have more cash on hand to cover operating expenses, make timely payments, and weather unexpected financial challenges.

- Enhanced financial health: Minimizing processing fees strengthens your company’s financial foundation, making it more attractive to investors and lenders.

- Negotiate with your payment processor: Contact your payment processor and ask for a lower rate. Explain your business’s volume and history and inquire about any potential discounts or fee reductions.

- Choose a processor with transparent fees: Avoid processors that hide fees or charge excessive rates. Look for a processor that provides clear and detailed fee schedules so you know exactly what you’re paying for.

- Offer alternative payment methods: Encourage customers to pay with cash, debit cards, or e-checks to reduce the number of credit card transactions you process. These alternative methods typically have lower processing fees.

- Educate customers about surcharges: Some businesses choose to pass on credit card processing fees to their customers by adding a surcharge to the total bill. However, it’s important to communicate this policy clearly and transparently to avoid any surprises or dissatisfaction among your customers.

- Use a high-volume processor: Payment processors often offer lower rates to businesses that process a high volume of transactions. If you have a significant amount of credit card sales, consider switching to a processor that caters to high-volume merchants.

- Qualify for interchange-plus pricing: Interchange-plus pricing allows you to pay the actual cost of processing each transaction plus a fixed markup from your payment processor. This can be a more cost-effective option than traditional tiered pricing, which charges higher fees for certain types of transactions.

- Process payments in-house: If you have the resources and expertise, consider processing credit cards in-house using your own equipment. This can eliminate the fees you pay to a third-party payment processor.

By following these tips, you can minimize or eliminate credit card processing fees and save your business money.

How to Avoid Credit Card Processing Fees?

Avoiding credit card processing fees is a critical step for businesses looking to maximize profitability and improve their financial health. These fees, typically charged by payment processors and banks, can eat into your margins and reduce your bottom line. By implementing strategic measures to minimize these charges, you can enhance your cash flow and boost your business’s overall performance.

Impact of Avoiding Credit Card Processing Fees

Reducing credit card processing fees can positively affect your business in several ways:

Strategies to Avoid Credit Card Processing Fees

There are various strategies you can adopt to avoid credit card processing fees:

Additional Tips to Reduce Credit Card Processing Fees

In addition to the strategies listed above, consider these additional tips to further reduce your credit card processing fees:

Conclusion

Avoiding credit card processing fees is essential for businesses looking to optimize their financial performance. By implementing the strategies and tips outlined above, you can minimize these fees and increase your profitability. Remember to regularly review your processing fees and explore new opportunities to reduce them even further. By taking a proactive approach to managing credit card processing expenses, you can enhance the financial health of your business and set it up for long-term success.

How to Avoid Credit Card Processing Fees: A Comprehensive Guide for Savvy Businesses

Navigating the labyrinthine world of credit card processing can be a daunting task for any business owner. The myriad of fees associated with accepting plastic payments can eat into your利润, leaving you wondering, "Is there a way out of this financial maze?"

Fear not, intrepid entrepreneur! By adopting a few clever strategies, you can effectively avoid credit card processing fees and keep more of your hard-earned money in your pocket. ## Understanding the Fees

Before we dive into the art of fee avoidance, it’s essential to understand the types of fees you’re up against. Interchange fees, those pesky charges levied by credit card companies, constitute the bulk of processing costs. Issuer fees, charged by the bank that issued the card, also take a bite out of your profits. And let’s not forget about network fees, assessed by payment processors for handling transactions. These fees can add up quickly, eroding your bottom line. ## Avoiding Interchange Fees

Interchange fees can be a real thorn in your business’s side, but there are ways to minimize their impact. One effective strategy is to negotiate lower rates with your payment processor. Be prepared to discuss your business volume and history as you seek a more favorable deal. Additionally, consider offering cash or debit card discounts to encourage customers to use lower-cost payment methods. ## Minimizing Issuer Fees

While issuer fees are typically non-negotiable, there are still ways to keep them in check. Focus on building strong relationships with your customers. By providing exceptional service and fostering loyalty, you can increase the likelihood of customers sticking with you, even if you have to pass on a small fee. Also, explore alternative payment processors that offer lower issuer fees. ## Waiving Network Fees

Network fees can be a significant expense, but they’re not always unavoidable. By partnering with payment processors that offer waived network fees, you can eliminate this cost altogether. Keep in mind that these partnerships may come with other requirements or higher interchange fees, so carefully consider your options before making a commitment. ## Surcharging: A Controversial Option

Surcharging, the practice of adding a surcharge to credit card transactions, has become a hot-button issue in the world of credit card processing. While surcharging can help businesses recoup the cost of fees, it can also alienate customers and lead to negative feedback. If you choose to implement surcharging, proceed with caution and be transparent with your customers about the reasons behind the additional charge. ## Exploring Alternative Payment Options

Embracing alternative payment options can also help you steer clear of credit card processing fees. Services like PayPal, Venmo, and Square offer lower transaction fees compared to traditional credit cards. By providing customers with a variety of payment choices, you can reduce your reliance on high-fee credit card transactions. ## Conclusion

By employing these strategies, you can effectively avoid credit card processing fees and optimize your business’s financial performance. Remember, every penny saved is a penny earned. So, take control of your payment processing costs and watch your profits flourish!