Offsetting Credit Card Processing Fees: Strategies For Businesses

Posted: 02 Apr 2025 on General

How to Offset Credit Card Processing Fees

As a business, you know that accepting credit cards is essential for increasing sales and making it easier for customers to make purchases. However, the fees associated with processing credit cards can eat into your profits, especially if you have a high volume of transactions. There are several ways to offset these fees, and we’ll explore some of the most effective methods in this article.

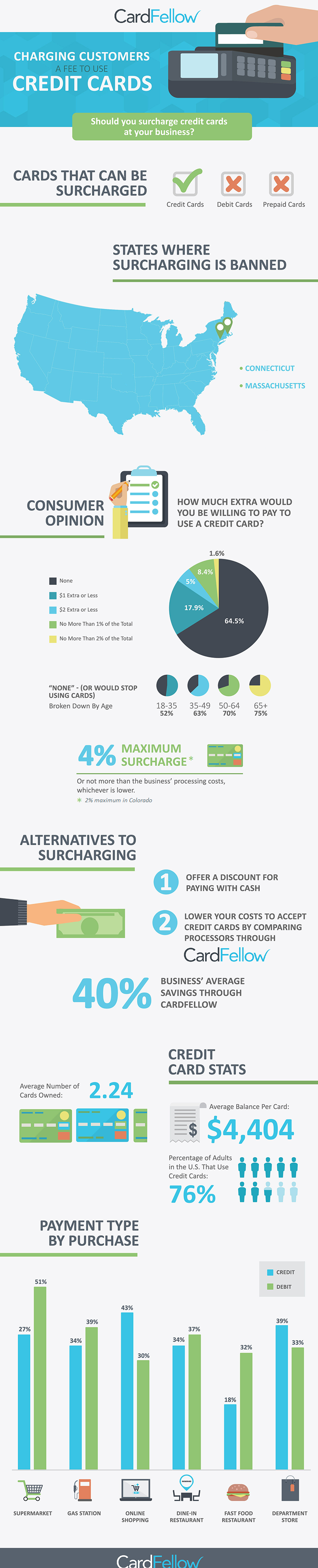

Surcharge Your Customers

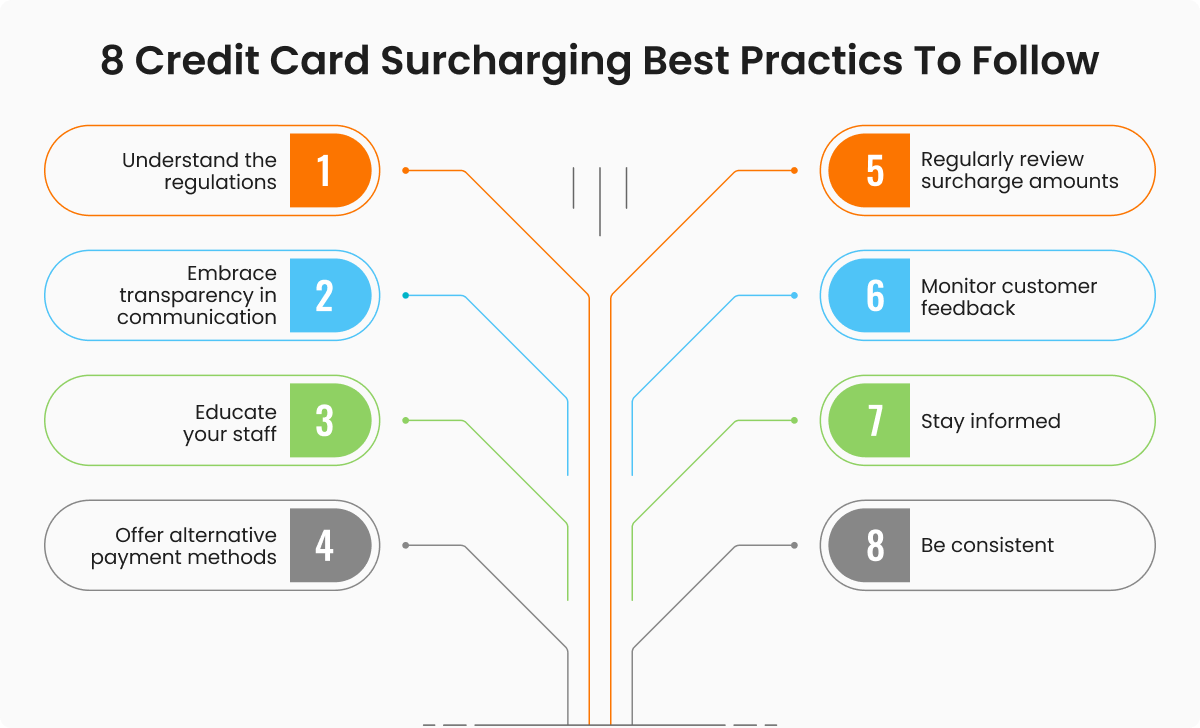

If allowed by law in your jurisdiction, you can add a surcharge to customer transactions to cover the cost of processing. This is a straightforward way to recoup the fees you pay to your payment processor, and it can be passed on to customers without significantly impacting their purchasing decisions. However, it’s important to note that surcharging can be unpopular with customers, so it’s important to communicate the reason for the surcharge clearly and transparently. Additionally, some credit card companies may prohibit surcharging, so it’s important to check with your processor before implementing this strategy.

To determine the appropriate surcharge amount, consider the following factors:

- The average cost of processing a credit card transaction

- The percentage of your transactions that are made with credit cards

- The amount of profit margin you want to maintain

Once you have calculated the appropriate surcharge amount, you need to decide how to implement it. You can add the surcharge as a separate line item on your invoices, or you can incorporate it into your product or service prices. It’s important to be transparent about the surcharge and to provide customers with a clear explanation of why it is being implemented.

Here are some additional things to consider when surcharging your customers:

- Make sure that the surcharge is legal in your jurisdiction.

- Be transparent about the surcharge and provide customers with a clear explanation of why it is being implemented.

- Keep the surcharge amount reasonable.

- Monitor the impact of the surcharge on your sales.

By following these tips, you can effectively surcharge your customers to offset credit card processing fees while minimizing the impact on your sales.

How to Offset Credit Card Processing Fees

Credit card processing fees can be a major expense for businesses, especially those that process a high volume of transactions. These fees can eat into your profits and make it difficult to stay competitive. Fortunately, there are a number of ways to offset these fees and save money.

Negotiate with Your Provider

One of the best ways to reduce your credit card processing fees is to negotiate with your provider. This may seem like a daunting task, but it’s important to remember that you’re not the only business that’s paying these fees. Your processor is likely willing to work with you to find a rate that works for both of you.

When negotiating with your provider, be sure to do your research. Know what other businesses are paying for similar services and be prepared to walk away if you can’t get a fair deal. You should also be willing to commit to a higher volume of transactions or other terms in order to get a better rate.

Ways To Negotiate A Better Deal With Your Provider

1. Understand Your Statement

The first step to negotiating a better deal with your provider is to understand your statement. This will help you see exactly how much you’re paying in fees and where you can save money. Look for any hidden fees or charges that you may not be aware of.

2. Compare Rates

Once you understand your statement, it’s time to compare rates with other providers. There are a number of online resources that can help you do this. Be sure to compare all of the fees, not just the processing rate. Some providers may have lower processing rates but higher fees for other services.

3. Negotiate

Once you’ve found a few providers that you’re interested in, it’s time to start negotiating. Be prepared to discuss your business needs and what you’re willing to pay. Be willing to walk away if you can’t get a fair deal.

In addition to negotiating with your provider, there are a number of other ways to offset credit card processing fees. These include:

- Passing on the fees to your customers. This is a common practice, but it’s important to be transparent with your customers about the fees.

- Offering discounts for cash or check payments. This can encourage customers to use alternative payment methods, which can save you money on processing fees.

- Using a payment processor that offers low fees. There are a number of payment processors that offer low fees, so it’s important to shop around for the best deal.

- Processing payments in batches. This can help you reduce your overall processing fees.

- Using a virtual terminal. This allows you to process payments online without having to use a physical credit card machine. This can save you money on processing fees.

- Partnering with a payment gateway. This can help you reduce the fees that you pay for processing online payments.

How to Offset Credit Card Processing Fees

Not a whole lot of people enjoy paying surcharges and extra fees. But, if you are a business owner, you’ll have to have a way to get paid. And the cost of doing business these days is only going up, so you’ll want to find ways to offset any additional expenses that may come up. If you accept credit card payments, you’re probably already familiar with the dreaded processing fees. These fees can eat into your profits, especially if you process a lot of transactions. But don’t worry, there are a few things you can do to offset these costs.

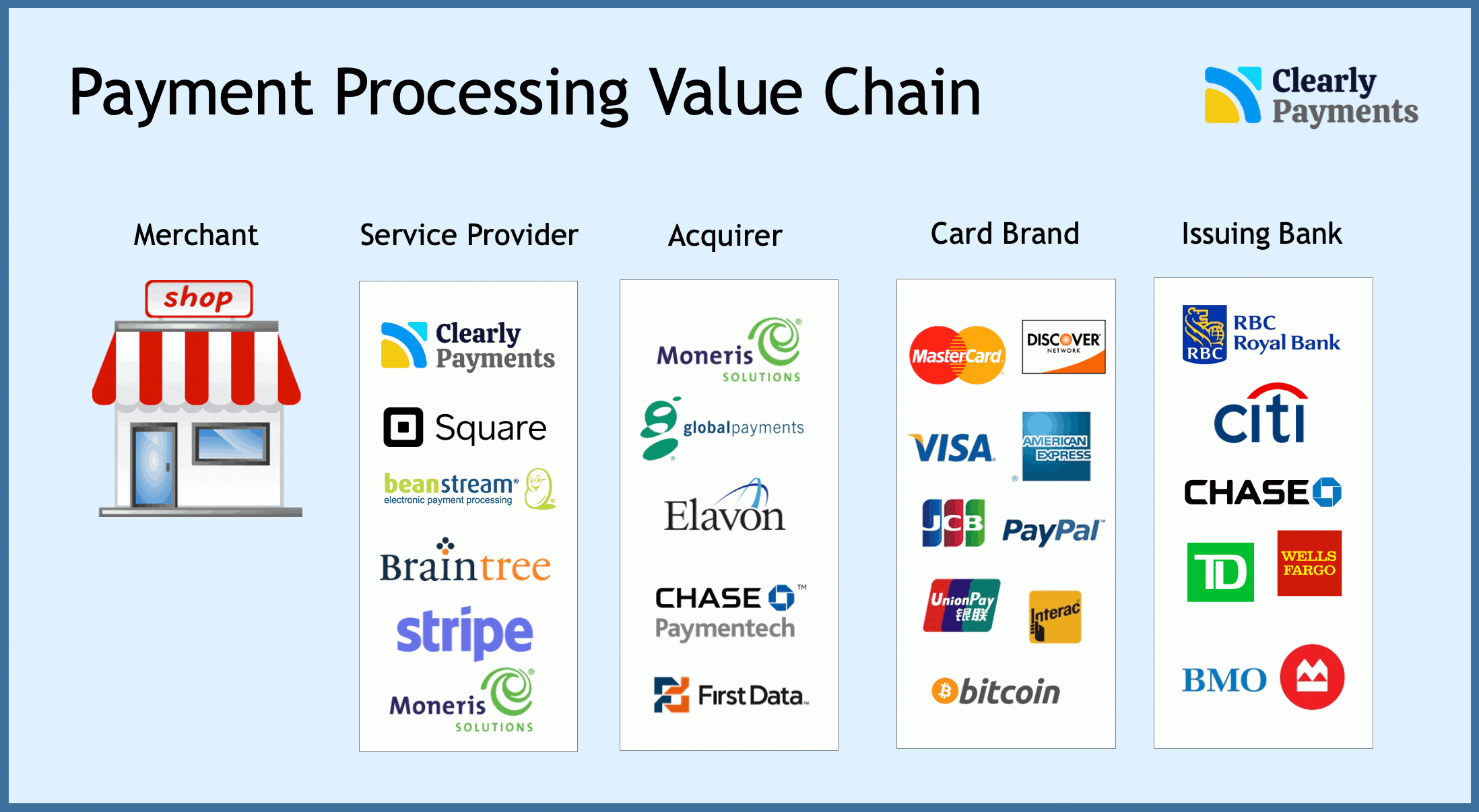

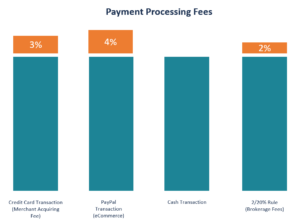

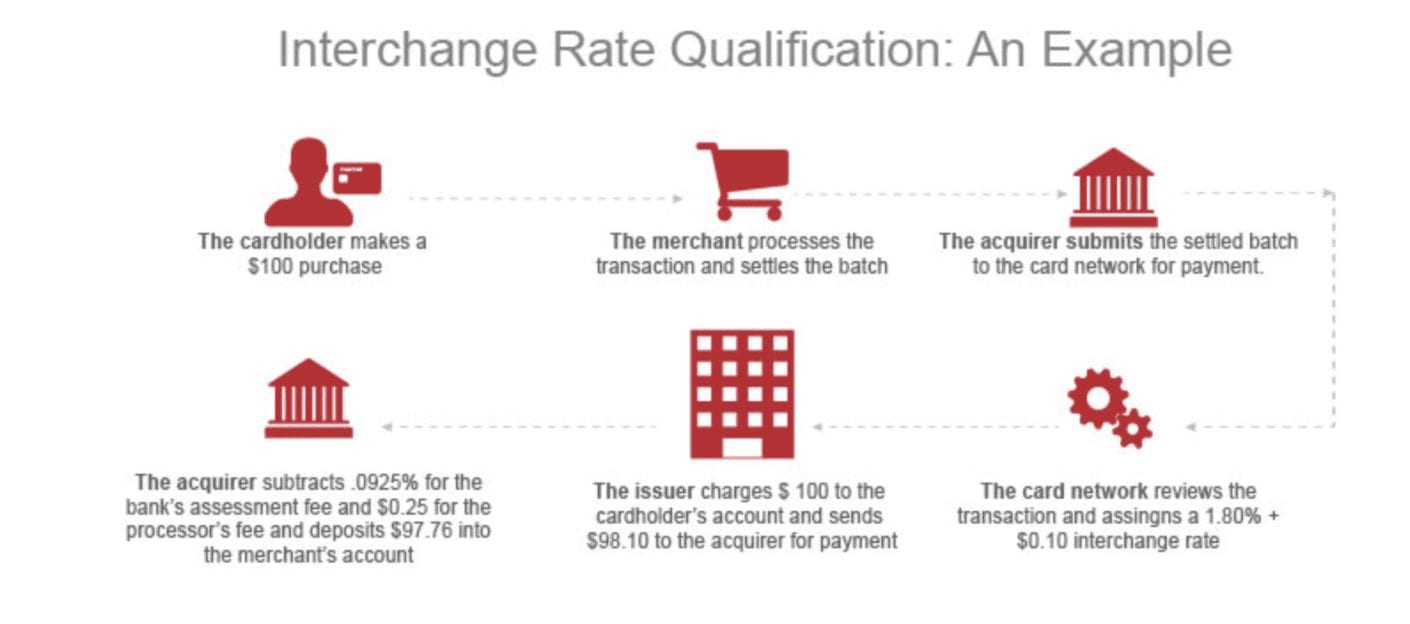

First, let’s take a look at what credit card processing fees are and why they’re so high. Credit card processing fees are the fees that businesses pay to credit card companies for processing credit card transactions. These fees can vary depending on the type of credit card, the amount of the transaction, and the business’s processing volume. Some of the most common credit card processing fees include:

- Transaction fees: These fees are charged for each credit card transaction that is processed. Transaction fees typically range from 1.5% to 3% of the transaction amount.

- Discount fees: These fees are charged to businesses that offer discounts to customers who pay with credit cards. Discount fees typically range from 0.5% to 1% of the transaction amount.

- Chargeback fees: These fees are charged to businesses that process chargebacks. Chargebacks occur when a customer disputes a transaction and requests a refund. Chargeback fees typically range from $15 to $75 per chargeback.

Now that you know what credit card processing fees are and why they’re so high, let’s take a look at a few things you can do to offset these costs:

Negotiate with Your Credit Card Processor

The first thing you can do to offset credit card processing fees is to negotiate with your credit card processor. Many processors are willing to negotiate rates, especially if you’re a high-volume merchant. The best way to get a better rate is to shop around and compare rates from different processors. Once you’ve found a few processors that offer competitive rates, you can start negotiating. Be prepared to provide your business’s processing volume and average transaction size. This information will help the processor determine what kind of rate they can offer you.

Use a Payment Gateway

A payment gateway is a third-party service that helps businesses process credit card transactions. Payment gateways can help you get access to better processing rates by allowing you to connect with multiple processors and choose the one with the lowest fees. Payment gateways can also help you streamline your payment processing operations and reduce your PCI compliance costs. PCI compliance is a set of security standards that businesses must meet in order to accept credit card payments. The cost of PCI compliance can be significant, so using a payment gateway can help you save money in the long run.

Offer Discounts for Cash Payments

If you’re really struggling to offset credit card processing fees, you can try offering discounts to customers who pay with cash. This will encourage customers to use cash instead of credit cards, which will save you money on processing fees. Just be sure to make the discount small enough that it doesn’t eat into your profits too much.

Increase Your Prices

If all else fails, you can always increase your prices to offset credit card processing fees. This is not the ideal solution, but it may be necessary if you’re unable to find other ways to save money on fees. Just be sure to increase your prices gradually so that you don’t alienate your customers.

Accept Credit Cards with No Surcharge

Many businesses choose to pass on the cost of credit card processing fees to their customers by adding a surcharge to credit card transactions. While this may seem like an easy way to offset fees, it can actually hurt your business in the long run. Customers are increasingly reluctant to pay surcharges, and they may choose to shop elsewhere if you charge them extra for using credit cards. It’s better to absorb the cost of credit card processing fees and keep your prices competitive.

Use a Credit Card Processor that Offers Interchange-Plus Pricing

Interchange-plus pricing is a type of credit card processing fee structure that passes the interchange fee (the fee that the credit card companies charge for each transaction) directly to the business. This type of pricing is more transparent than traditional tiered pricing, and it can help businesses save money on credit card processing fees. However, interchange-plus pricing is not available from all credit card processors. If you’re interested in using interchange-plus pricing, you’ll need to shop around and compare rates from different processors.

Process Credit Cards in-House

If you have a high volume of credit card transactions, you may be able to save money by processing them in-house. In-house processing involves purchasing your own credit card terminal and payment gateway. This can be a significant investment, but it can save you money in the long run if you process a lot of transactions. However, in-house processing is not right for every business. If you don’t have the resources to manage your own credit card processing, it’s best to outsource this task to a third-party provider.

Conclusion

Credit card processing fees can be a significant expense for businesses. However, there are a number of things you can do to offset these costs. By negotiating with your processor, using a payment gateway, offering discounts for cash payments, and increasing your prices, you can reduce the impact of credit card processing fees on your bottom line.

How to Offset Credit Card Processing Fees

Credit card processing fees can chip away at your business’s bottom line. However, there are ways to offset these costs without sacrificing your sales volume. In this article, we’ll explore six actionable strategies to help you recoup your processing fees and increase your profits.

1. Negotiate with Your Payment Processor

Don’t be afraid to negotiate with your payment processor. Many providers are willing to work with you to lower your fees. You may not realize it, but payment processors are businesses, too. They want to make money by attracting and retaining customers. If you aren’t happy with your current rates, reach out to your provider and see if you can negotiate a better deal. Be prepared to discuss your transaction volume and history. You may also want to get quotes from other processors to see if you can find a better rate.

2. Offer Discounts for Cash Payments

Offering discounts for cash payments is a great way to encourage customers to pay without using credit cards. This can save you thousands of dollars in processing fees each year. There are a few different ways to offer discounts for cash payments. You could offer a flat percentage discount, such as 2% or 3%. Or, you could offer a tiered discount, such as 5% off for purchases over $100 and 10% off for purchases over $200.

3. Increase Your Sales Volume

The more transactions you process, the lower your effective processing rate will be. Focus on increasing your sales volume to spread out the cost of processing. There are a few different ways to increase your sales volume. You could offer discounts, promotions, and loyalty programs. You could also expand your product line or offer new services.

4. Use a Payment Gateway that Offers Interchange-Plus Pricing

Interchange-plus pricing is a type of payment processing fee structure that allows you to see the breakdown of the fees you’re paying. This can help you identify areas where you can save money. For example, if you’re paying a high interchange fee, you may be able to negotiate a lower rate with your issuing bank.

5. Use a Virtual Terminal

A virtual terminal is a software program that allows you to process credit card payments online. Virtual terminals typically have lower processing fees than traditional point-of-sale systems. This is because virtual terminals don’t require you to purchase or rent hardware.

6. Offset Your Processing Fees with Other Revenue Streams

If you’re struggling to offset your credit card processing fees, you may want to consider offsetting them with other revenue streams. For example, you could offer a subscription service or sell gift cards. You could also offer additional services, such as consulting or training.

Conclusion

Credit card processing fees can be a drag on your business’s bottom line. However, there are many ways to offset these costs and keep your business profitable. By following the tips in this article, you can reduce your effective processing rate and improve your cash flow.

How to Offset Credit Card Processing Fees

In today’s fiercely competitive business environment, maximizing revenue and minimizing costs are essential for survival. One common expense that businesses often overlook is credit card processing fees. These fees can chip away at your hard-earned profits, especially if you process a high volume of transactions. But don’t despair! There are several effective strategies you can employ to offset these fees and keep more of your hard-earned cash. Here’s a comprehensive guide to help you navigate the ins and outs of credit card processing fees and find practical solutions to reduce their impact:

Negotiate with Your Processor

Your credit card processor is not a monolith; it’s a business like any other, and just like any other business, it’s willing to negotiate. Don’t be afraid to ask for lower rates or better terms. If you’re a loyal customer with a good payment history, you might be surprised at what your processor is willing to do to keep your business.

Pass the Fees to Your Customers

This is a straightforward approach: let your customers foot the bill for the credit card processing fees. You can do this by adding a surcharge to all credit card transactions. However, it’s crucial to be transparent about this surcharge. Let your customers know upfront that they will be charged an additional fee for using a credit card.

Surcharge High-Value Transactions

If you’re hesitant to pass on the fees to all your customers, consider targeting only high-value transactions. This could involve imposing a surcharge on purchases over a certain amount, such as $100 or $200. This way, you’re only charging the customers who are most likely to offset the cost with their purchase.

Offer Discounts for Cash

Encourage your customers to use cash by offering them a discount for doing so. This could be a small discount, such as 2% or 3%, but it can add up over time. If you’re worried about losing customers who prefer to use credit cards, offer the discount as a loyalty program perk. That way, you’re rewarding customers who are already loyal to your business and giving them an incentive to continue using cash.

Use a Payment Processor That Offers Low Rates

Not all payment processors are created equal. Some processors offer lower rates than others. It’s worth shopping around to find the best deal. When comparing processors, be sure to consider all the fees, not just the transaction fee. Some processors may have hidden fees that can add up over time.

Consider a Merchant Cash Advance

A merchant cash advance can provide you with a lump sum of cash in exchange for a percentage of your future sales. This can help you cover the upfront costs of processing fees. Keep in mind, however, that merchant cash advances typically come with high fees and should be considered a last resort.

Additional Tips

- Negotiate with your processor: Don’t be afraid to ask for lower fees or better terms.

- Consider a merchant cash advance: This can provide you with a lump sum of cash to cover the upfront costs of processing fees.

- Offer discounts for cash: This can encourage customers to use cash and reduce your processing fees.

- Use a payment processor that offers low rates: Not all processors are created equal. Shop around to find the best deal.

- Pass the fees to your customers: This is a straightforward approach. Add a surcharge to all credit card transactions.

- Surcharge high-value transactions: This allows you to target only the customers who are most likely to offset the cost.

- Set up a loyalty program: Offer discounts or rewards to customers who use cash.

- Consider a payment gateway: This can help you process payments online.

- Be transparent: Let your customers know that they will be charged a surcharge for using a credit card.

- Be competitive: Make sure your fees are in line with your competitors.

- Optimize your website for mobile: This will make it easier for customers to pay with their mobile devices.

- Monitor your processing fees: Keep track of your fees to ensure that you’re getting the best possible deal.

- Be patient: It may take some time to find the best solution for your business.