Restaurant Credit Card Processing Fees: A Comprehensive Guide

Posted: 02 Apr 2025 on General

Restaurant Credit Card Processing Fees: A Comprehensive Guide

In the realm of modern dining, credit cards have become ubiquitous. They offer convenience and security to diners, but their use comes with an inherent cost: credit card processing fees. These fees can chip away at a restaurant’s bottom line, making it crucial for business owners to understand the factors that influence them and how to negotiate the best possible rates.

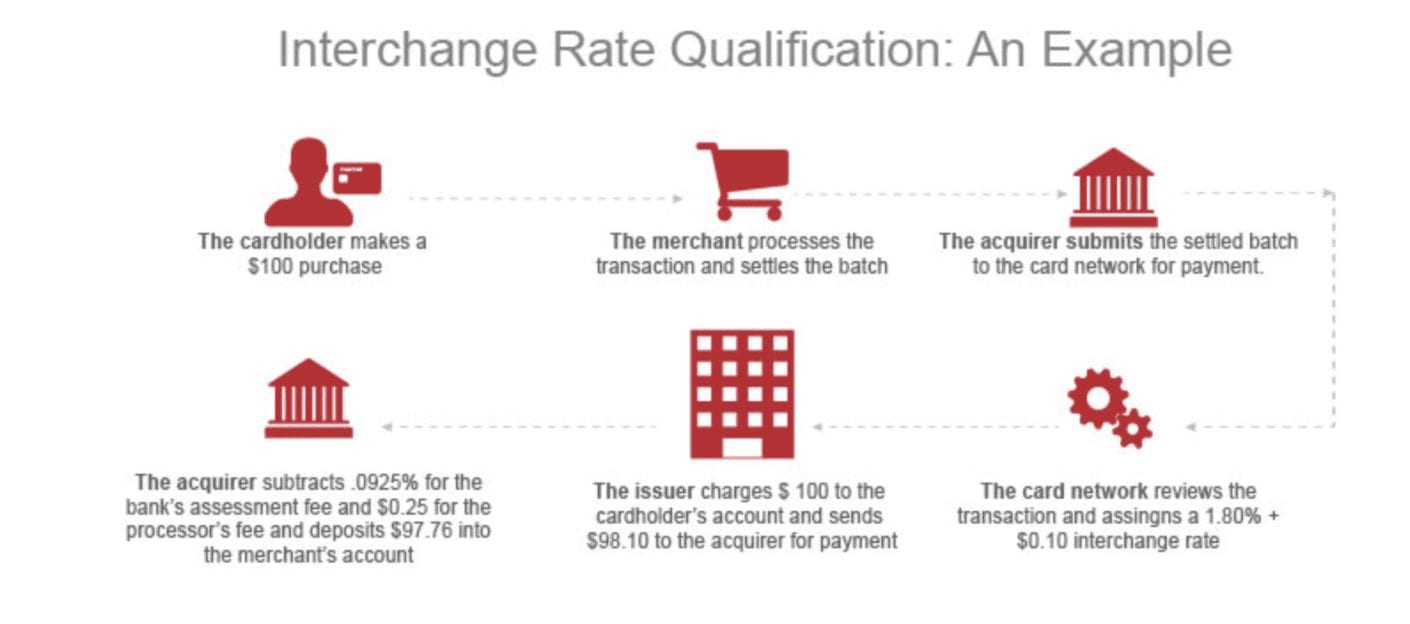

Credit card processing fees are typically structured as a percentage of each transaction, plus a flat fee. So the more you process, the more you pay. That’s why leveraging your business volume is a powerful tool in negotiating lower rates. The more transactions you can bring to a payment processor, the more they’re likely to give you a break on fees.

Negotiating Fees

Negotiating lower credit card processing fees is not a one-size-fits-all process. Every business is different, so what works for one may not work for another. However, there are some general tips that can help:

- Shop around: Don’t be afraid to get quotes from multiple payment processors before making a decision. Compare not only fees but also features and customer service.

- Leverage your business volume: As mentioned above, the more transactions you process, the more leverage you have in negotiations.

- Ask for a rate review: If you’ve been a loyal customer for a while, ask your payment processor for a rate review. They may be willing to give you a discount based on your history.

- Be willing to walk away: If you can’t get a fair deal, be prepared to walk away and take your business elsewhere. There are plenty of other payment processors out there.

Remember negotiating credit card processing fees is an ongoing process. As your business grows and changes, your needs may change as well. Be sure to review your rates regularly and negotiate as needed to ensure you’re getting the best deal possible.

Restaurant Credit Card Processing Fees: Everything You Need to Know

Restaurant owners, listen up! Understanding credit card processing fees is crucial for managing your business expenses effectively.

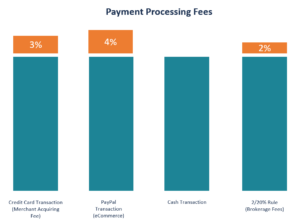

Credit card processing fees, typically ranging from 2% to 4%, can significantly impact your bottom line. These fees cover the costs incurred by banks and credit card companies to process transactions, including authorization, verification, and fraud prevention.

Navigating the complexities of credit card processing fees can be daunting, but with the right knowledge and strategies, you can minimize them and maximize your profits.

Types of Credit Card Processing Fees

There are several types of credit card processing fees you need to be aware of:

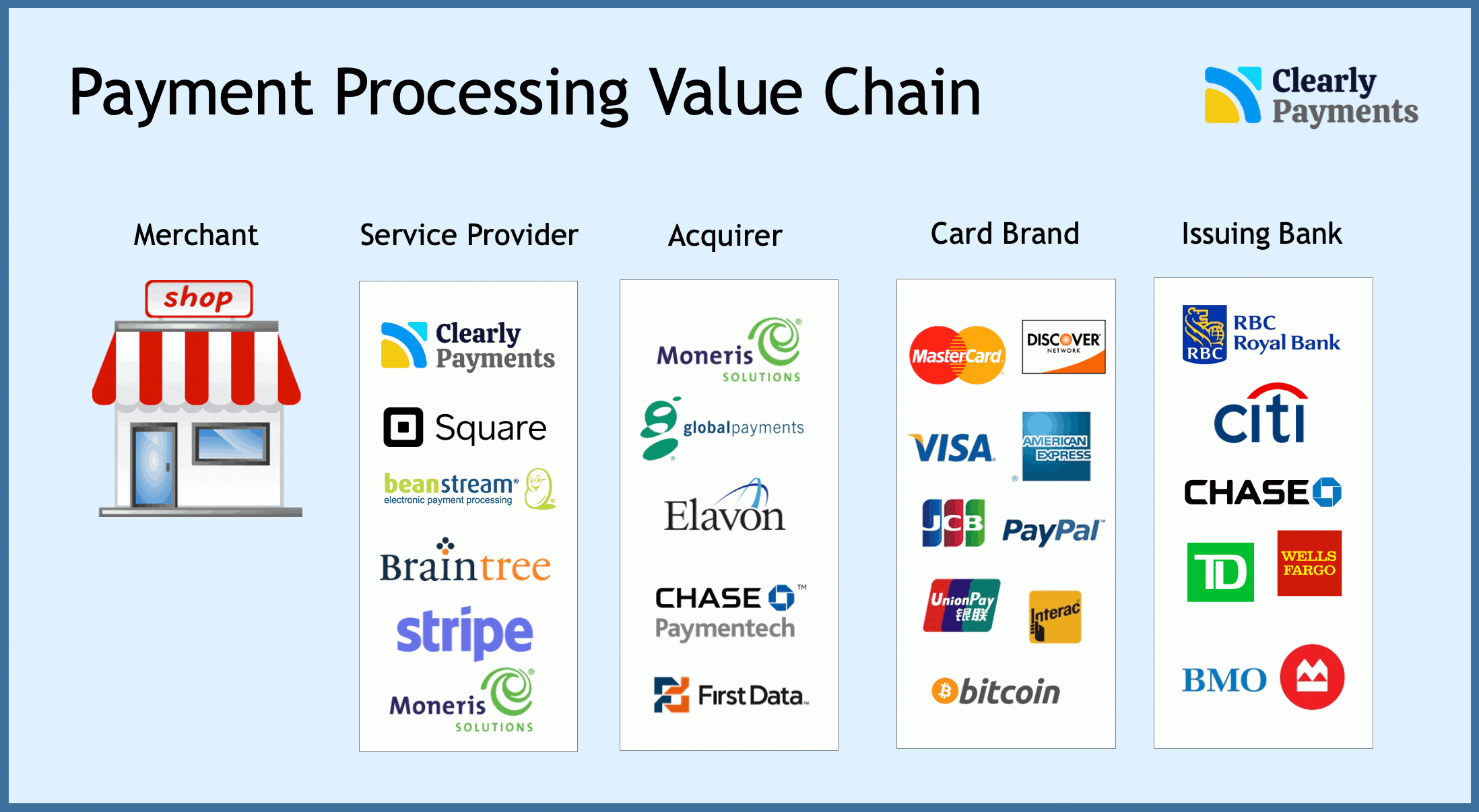

- Interchange fees: These are fees paid to the bank that issued the credit card.

- Assessment fees: These fees are paid to the credit card network (e.g., Visa, Mastercard).

- Processor fees: These fees are paid to the payment processor that handles the transaction.

- Gateway fees: These fees are paid to the gateway that securely connects your POS system to the payment processor.

Best Practices for Minimizing Fees

Now that you know the different types of fees, let’s dive into some practical tips to reduce them:

Negotiate with Your Processor

Like any business deal, you can negotiate with your credit card processor to get a better rate. Don’t be afraid to ask for a lower rate, especially if you process a high volume of transactions.

Optimize Your Transactions

Every transaction incurs a fee, so it’s crucial to optimize your processes to minimize these fees. For instance, consider offering discounts for cash payments or encouraging customers to use debit cards instead of credit cards.

Use Electronic Invoicing

Electronic invoicing is more efficient and cost-effective than traditional paper invoicing. By sending invoices electronically, you can reduce postage costs and eliminate the risk of lost or delayed payments.

Chargeback Prevention

Chargebacks are when a customer disputes a transaction and asks their bank to reverse it. They can be costly for businesses, so take measures to prevent them, such as having a clear return policy and documenting all transactions.

Monitor Your Fees

Regularly review your credit card processing statements to identify any unusual charges or discrepancies. By monitoring your fees, you can identify potential areas for savings.

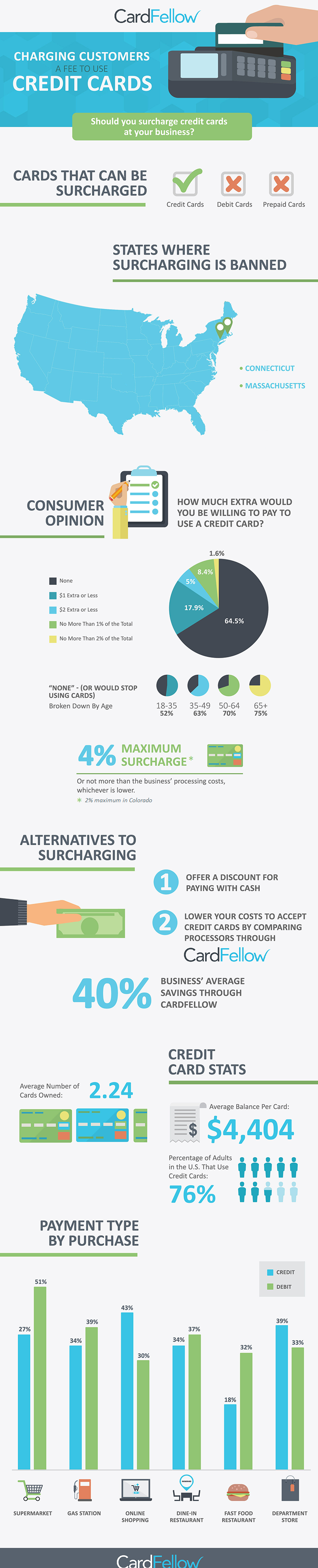

Consider Surcharging

In some states, restaurants are permitted to add a surcharge to cover the cost of credit card processing. However, it’s important to check your local regulations and weigh the potential risks and benefits before implementing surcharging.

Choosing the Right Credit Card Processor

Selecting the right credit card processor is crucial for minimizing fees. Look for a processor that offers competitive rates, transparent pricing, and reliable service. Consider factors like the volume of transactions you process, the types of cards you accept, and the level of customer support you need.

The Impact of Credit Card Processing Fees on Restaurants

Credit card processing fees can significantly impact restaurant profitability. For example, a restaurant that processes $100,000 in credit card transactions per month could pay around $2,000 to $4,000 in fees. These fees can eat into your profit margin and limit your ability to invest in other areas of your business.

In an industry where margins are often tight, minimizing credit card processing fees is essential for maintaining profitability and staying competitive.

Conclusion

Understanding and managing credit card processing fees is vital for successful restaurant operations. By adopting best practices and implementing effective strategies, you can minimize these fees and maximize your profits. Remember, every cent you save on processing fees is a cent that goes straight to your bottom line.