Squarespace Credit Card Processing Fees

Posted: 02 Apr 2025 on General

Squarespace Credit Card Processing Fees

Squarespace’s credit card processing fees are a hot topic among small business owners. Business owners want to know how much they’ll be charged for each transaction, and how those fees compare to other options. Is Squarespace’s pricing competitive? Will Squarespace’s fees eat into your profits? Fortunately, the answers to these questions are readily available with a little research, and we’ll help you do it here. In this article, we’ll take a close look at Squarespace’s credit card processing fees. We’ll also provide some tips on how to minimize your fees. By the end of this article, you’ll have a good understanding of Squarespace’s credit card processing fees. You’ll also be able to make an informed decision about whether or not Squarespace is the right platform for your business.

How Much Are Squarespace’s Credit Card Processing Fees?

Squarespace’s credit card processing fees are as follows:

*2.9% + 30¢ per transaction for all major credit cards (Visa, Mastercard, American Express, Discover)

*3.5% + 30¢ per transaction for American Express cards

*These fees are in addition to the monthly fee you pay for your Squarespace account.

For example, if you sell a product for $100, you’ll pay $2.90 + 30¢ in credit card processing fees. If you sell a product for $1,000, you’ll pay $29 + 30¢ in credit card processing fees.

You can use Squarespace’s fee calculator to estimate your credit card processing costs.

Squarespace’s credit card processing fees are comparable to other popular e-commerce platforms. For example, Shopify charges 2.9% + 30¢ per transaction for all major credit cards, and 3.5% + 30¢ per transaction for American Express cards. Wix charges 2.9% + 30¢ per transaction for all major credit cards.

How Can I Minimize My Squarespace Credit Card Processing Fees?

There are a few things you can do to minimize your Squarespace credit card processing fees:

- Negotiate with your payment processor. If you process a large volume of transactions, you may be able to negotiate a lower rate with your payment processor.

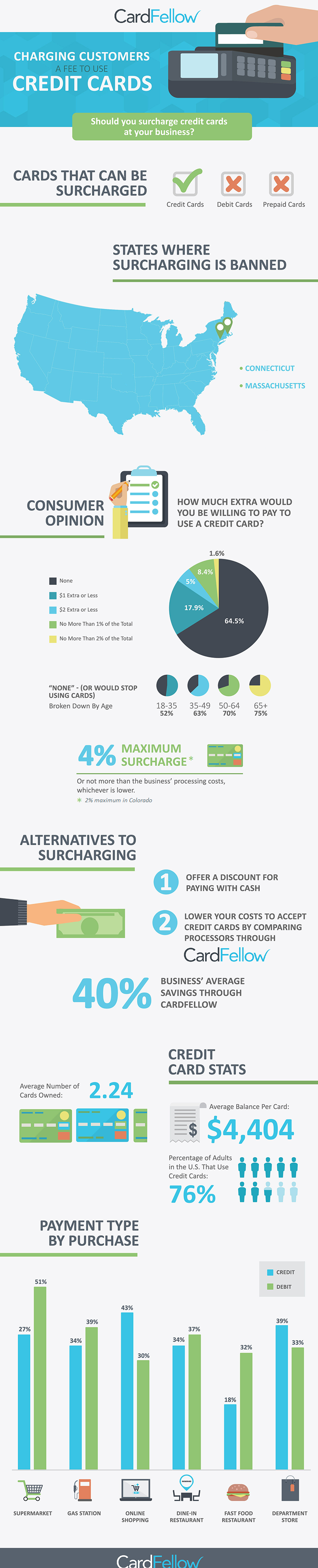

- Offer discounts for cash payments. If you’re willing to accept cash payments, you can offer a discount to customers who choose to pay this way. This can help you offset the cost of your credit card processing fees.

- Use a payment gateway that offers lower fees. There are a number of payment gateways that offer lower fees than Squarespace. If you’re not happy with Squarespace’s fees, you can switch to a different payment gateway.

- Increase your sales volume. The more sales you make, the lower your average credit card processing fees will be. This is because your fees are spread out over a larger number of transactions.

Looking at the bigger picture, It’s important to remember that credit card processing fees are a cost of doing business. If you’re not willing to pay these fees, you won’t be able to accept credit cards from your customers. That said, there are a few things you can do to minimize your fees. By following the tips in this article, you can save money on your credit card processing fees and increase your profits.

SquareSpace Credit Card Processing Fees: A Comprehensive Guide

If you’re considering using SquareSpace to build your online store, it’s essential to understand their credit card processing fees. These fees can eat into your profits, so it’s important to factor them into your budget. In this article, we’ll break down SquareSpace’s credit card processing fees and provide tips for minimizing them.

Types of Credit Card Processing Fees

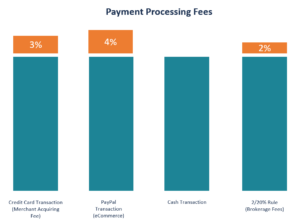

There are two main types of credit card processing fees: percentage-based fees and flat fees. Percentage-based fees are a percentage of each transaction, while flat fees are a fixed amount per transaction.

Percentage-based fee

SquareSpace charges a percentage-based fee of 2.9% for all plans, regardless of the type of credit card used. This means that for every $100 you sell, SquareSpace will charge you $2.90.

Flat Fees

SquareSpace does not charge any flat fees for credit card processing. However, some payment gateways, such as PayPal, may charge flat fees. If you’re using a payment gateway other than SquareSpace’s, be sure to check their fees before signing up.

Additional Fees

In addition to the percentage-based and flat fees, there are a few other fees that you may encounter when processing credit cards. These fees include:

- Chargeback fees: These fees are charged when a customer disputes a transaction and requests a refund.

- Foreign transaction fees: These fees are charged when you process a transaction in a currency other than your home currency.

- PCI compliance fees: These fees are charged to businesses that are required to comply with the Payment Card Industry Data Security Standard (PCI DSS).

Tips for Minimizing Credit Card Processing Fees

Here are a few tips for minimizing your credit card processing fees:

- Negotiate with your payment processor: If you have a high volume of sales, you may be able to negotiate a lower percentage-based fee with your payment processor.

- Use a payment gateway that offers low fees: Some payment gateways, such as Stripe, offer lower fees than others.

- Encourage customers to use debit cards: Debit cards typically have lower processing fees than credit cards.

- Offer discounts for cash payments: Offering a discount for customers who pay with cash can help you avoid credit card processing fees altogether.

By following these tips, you can minimize your credit card processing fees and keep more of your hard-earned profits.

Squarespace Credit Card Processing Fees: A Detailed Breakdown

If you’re running an online business through Squarespace, understanding their credit card processing fees is crucial. These fees can significantly impact your profits, so it’s essential to have a clear idea of what you’re paying before you start selling. In this article, we’ll break down Squarespace’s credit card processing fees, including flat fees, variable fees, and additional costs.

Flat Fee

Squarespace charges a flat fee of 30 cents per transaction for all plans, regardless of the type of credit card used. This fee is added to the variable fee, which we’ll discuss in the next section. The flat fee is a relatively small cost, but it can add up over time, especially if you process a high volume of transactions.

Variable Fee

The variable fee is the percentage of each transaction that Squarespace charges you for processing. This fee varies depending on the type of credit card used and the plan you’re on. For example, the variable fee for Visa and Mastercard is 2.9%, while the fee for American Express is 3.9%. The variable fee is the largest component of Squarespace’s credit card processing fees, so it’s important to consider this when pricing your products or services.

Additional Costs

In addition to the flat fee and variable fee, there are a few other costs you may encounter when using Squarespace’s credit card processing services. These costs include:

- Chargeback fees: If a customer disputes a transaction and requests a chargeback, you’ll be charged a fee of $15.

- Refund fees: If you refund a transaction, you’ll be charged a fee of 30 cents.

- Foreign transaction fees: If you process a transaction in a currency other than your home currency, you’ll be charged a fee of 1%.

Understanding Your Fees

The best way to manage your credit card processing fees is to understand how they work. By knowing the flat fee, variable fee, and additional costs, you can make informed decisions about your pricing and business practices. Here are a few tips for reducing your credit card processing fees:

- Negotiate with your payment processor: If you process a high volume of transactions, you may be able to negotiate a lower variable fee with your payment processor.

- Use a payment gateway that offers competitive rates: There are a number of payment gateways that offer competitive rates on credit card processing. By shopping around, you can find a solution that meets your needs and budget.

- Offer discounts for cash or check payments: To encourage customers to pay by cash or check, you can offer discounts for these payment methods. This can help you save money on credit card processing fees.

Conclusion

Credit card processing fees are an important consideration for any business that accepts online payments. By understanding Squarespace’s credit card processing fees, you can make informed decisions about your pricing and business practices. By following the tips in this article, you can reduce your credit card processing fees and maximize your profits.

Squarespace Credit Card Processing Fees: A Comprehensive Guide

Are you contemplating using Squarespace for your online business? If so, it’s essential to have a firm grasp of the platform’s credit card processing fees to make informed decisions about your payment strategy. In this article, we’ll break down the various fees associated with Squarespace and provide insights to help you navigate this aspect of your online venture.

Transaction Fees

Squarespace charges a flat transaction fee for each credit card purchase processed through its platform. The fee varies depending on the type of credit card used:

- Visa, Mastercard, Discover: 2.9% + $0.30 per transaction

- American Express: 3.5% + $0.30 per transaction

These fees are competitive with other e-commerce platforms and comparable to industry standards.

Business Plan Fees

Squarespace offers three business plans: Personal, Business, and Commerce. The Business plan, which costs $23 per month, includes additional features like abandoned cart recovery and gift cards. However, the transaction fees remain the same regardless of the plan you choose.

Annual Fees

Squarespace does not charge any annual fees for using its platform. This is a notable advantage over some competing platforms that may impose yearly charges.

Additional Fees

There are no additional fees associated with processing credit cards through Squarespace. This includes fees for PCI compliance, chargebacks, or refunds. This can save you a significant amount of money compared to other platforms that charge these additional fees.

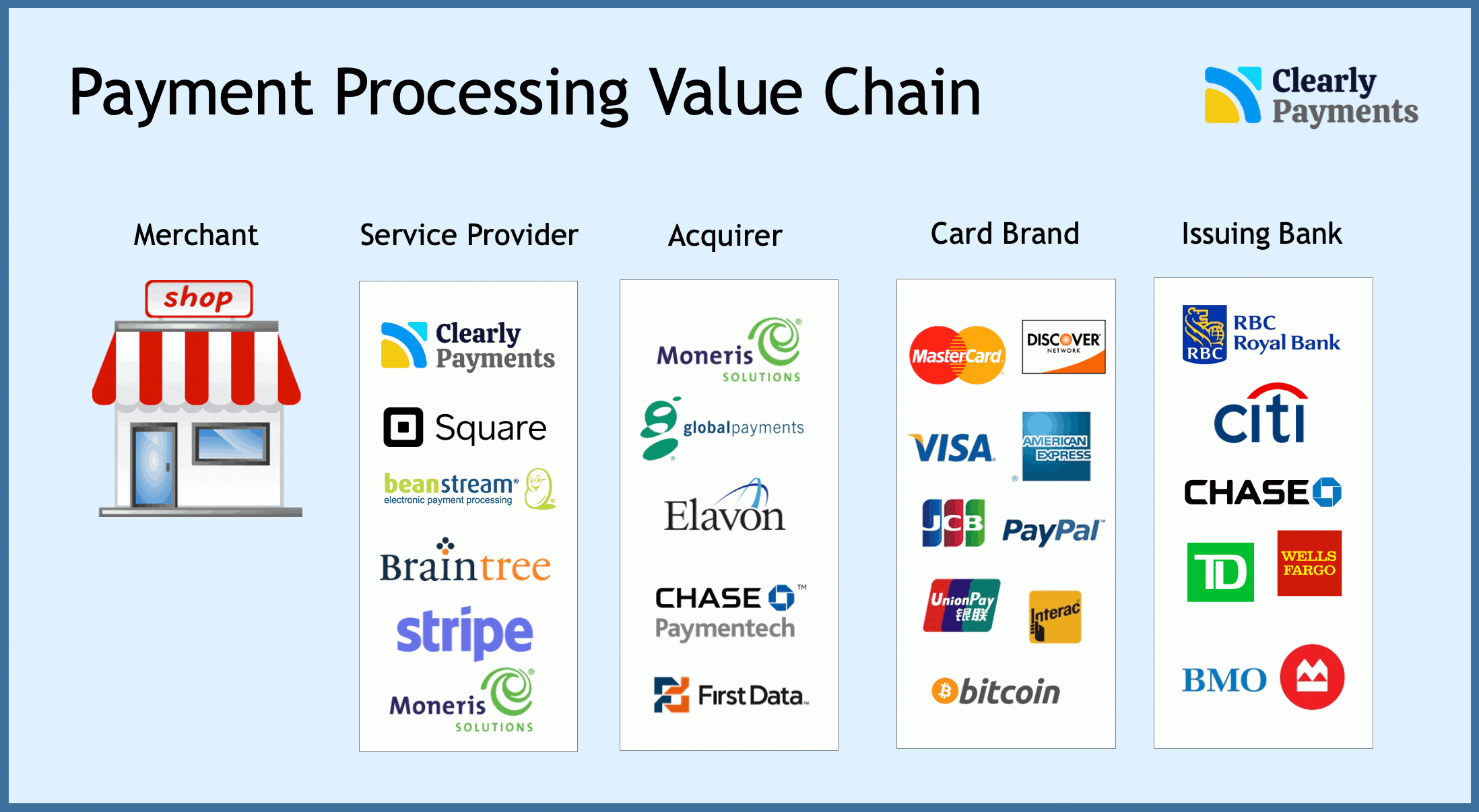

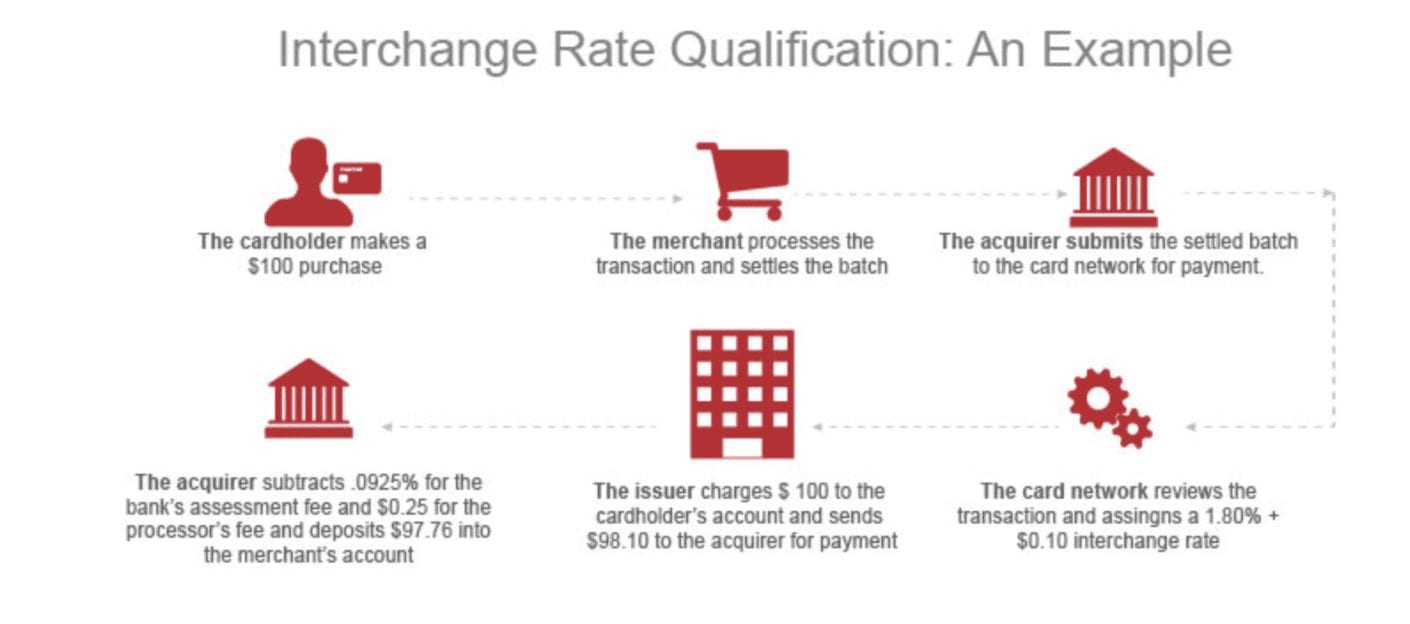

Understanding the Importance of Transaction Fees

Transaction fees are an unavoidable expense for any online business. They represent the cost of processing credit card payments, which includes verifying the transaction, authorizing the purchase, and transferring funds to your account. While it’s tempting to minimize these fees, it’s important to view them as a necessary investment in your business.

Think of it like this: every transaction is an opportunity to generate revenue and build relationships with customers. The transaction fee you pay is essentially the cost of acquiring new customers and growing your business. By providing a seamless and secure checkout experience, you increase the likelihood of conversions and customer satisfaction.

Tips for Minimizing Credit Card Processing Fees

While you can’t eliminate transaction fees altogether, there are several steps you can take to minimize their impact on your bottom line:

- Negotiate with your credit card processor: Contact your credit card processor and inquire about potential discounts or lower fees based on your business volume or transaction history.

- Use a payment gateway with lower fees: Squarespace integrates with various payment gateways, each with its own fee structure. Research different gateways to find one that offers competitive fees.

- Offer alternative payment methods: Consider providing alternative payment options such as PayPal or Apple Pay, which may have lower fees than traditional credit cards.

Conclusion

The credit card processing fees associated with Squarespace are reasonable and comparable to industry standards. By understanding the fees and implementing strategies to minimize their impact, you can ensure that your online business operates efficiently and profitably. Remember, transaction fees are an investment in the growth and success of your venture.