Stripe Credit Card Processing Fee

Posted: 02 Apr 2025 on General

Stripe Credit Card Processing Fees: A Comprehensive Guide

Stripe, a renowned payment processing platform, has carved a niche for itself with its competitive fees and highly adaptable features. When it comes to processing credit card payments through Stripe, business owners must navigate a transparent fee structure to optimize their financial operations.

This comprehensive guide will delve into the intricacies of Stripe’s credit card processing fees, providing you with a clear understanding of how they work, how they’re calculated, and how you can tailor them to your business needs. By the end of this article, you’ll be equipped to make informed decisions that can positively impact your bottom line.

Stripe’s Credit Card Processing Fee Structure

Stripe’s credit card processing fees adhere to a straightforward structure, ensuring transparency and predictability for businesses. The fee structure is composed of two primary components:

- Transaction Fee: This fee is charged for each successful credit card transaction processed through Stripe. The transaction fee varies depending on the type of card used, the region of the transaction, and the processing method (e.g., online, in-person, etc.).

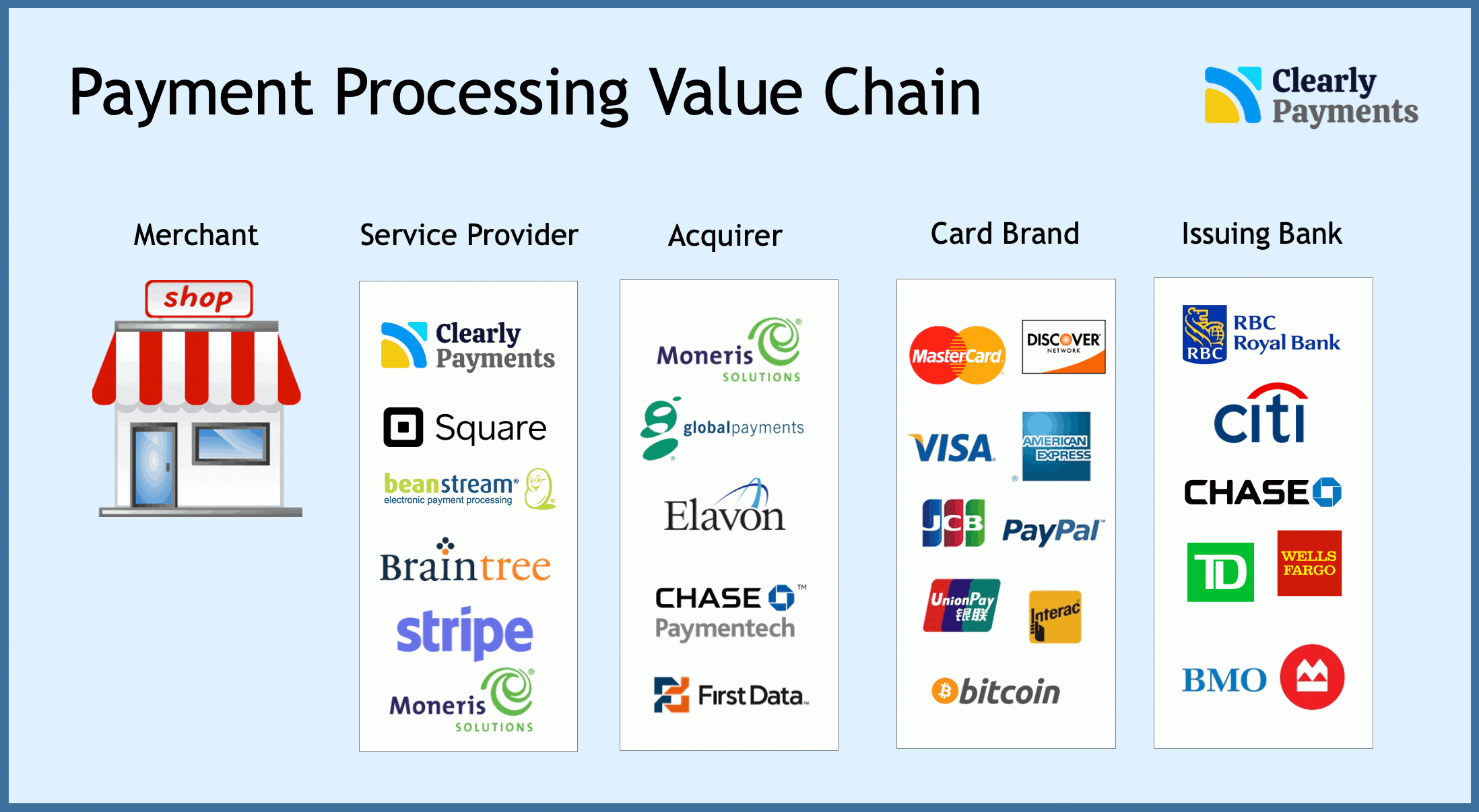

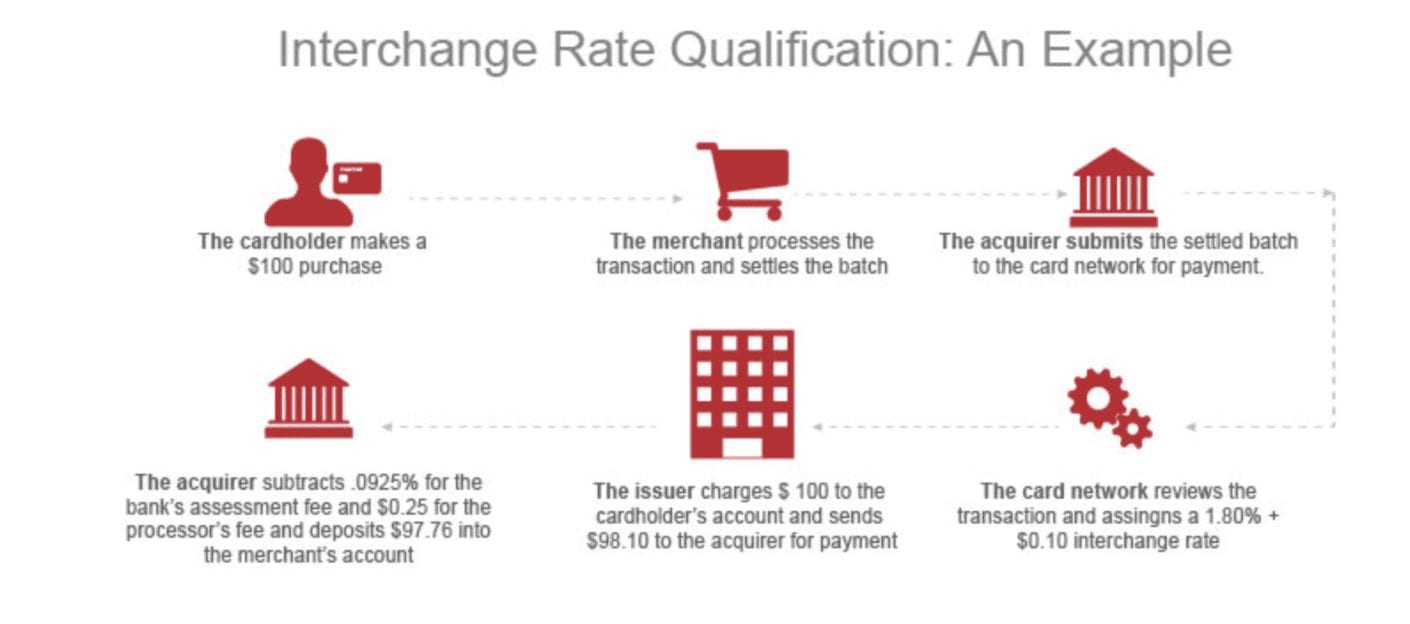

- Interchange Fee: Interchange fees are levied by the credit card networks (e.g., Visa, Mastercard) to cover the costs associated with processing transactions. These fees are typically passed on to merchants by payment processors like Stripe.

In addition to these two primary components, Stripe may also charge additional fees for specific services, such as:

- Chargeback Fees: Charged when a customer disputes a transaction and requests a chargeback.

- Cross-Border Fees: Applied to transactions involving different currencies or countries.

- PCI Compliance Fees: Optional fees for businesses that require assistance with maintaining compliance with the Payment Card Industry Data Security Standard (PCI DSS).

Factors Influencing Stripe’s Credit Card Processing Fees

Several factors can influence the overall credit card processing fees charged by Stripe. These factors include:

- Type of Card: Different types of credit cards, such as Visa, Mastercard, and American Express, have varying interchange fees. Premium or rewards cards often carry higher interchange fees.

- Region of Transaction: Interchange fees and transaction fees can differ based on the country or region where the transaction takes place.

- Processing Method: Online transactions typically incur lower fees compared to in-person or over-the-phone transactions.

- Volume of Transactions: Businesses that process a high volume of transactions may be eligible for discounted rates or tiered pricing.

- Stripe Account Type: Stripe offers different account types with varying fee structures. The type of account you choose will impact your overall processing fees.

Optimizing Stripe’s Credit Card Processing Fees

By considering the factors that influence Stripe’s credit card processing fees, businesses can explore various strategies to optimize their costs:

- Negotiating Interchange Fees: Businesses with substantial transaction volumes may have the power to negotiate lower interchange fees with their acquiring bank.

- Selecting the Right Stripe Account Type: Stripe provides different account types, each with its own fee structure. Choosing the account type that aligns with your business needs can help you save on fees.

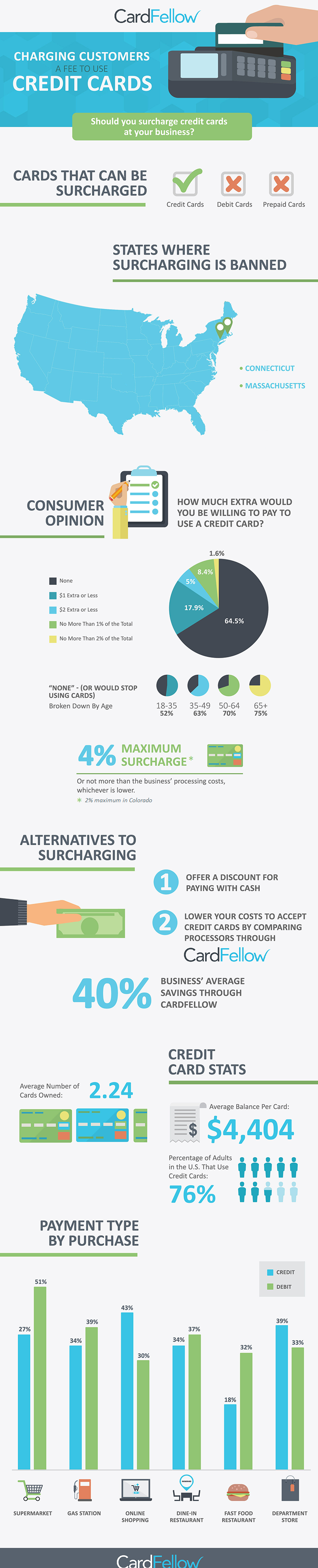

- Encouraging Customers to Use Cards with Lower Interchange Fees: Promote the use of cards with lower interchange fees, such as debit cards or prepaid cards.

- Leveraging Stripe’s Fee Calculator: Stripe’s fee calculator is a valuable tool that allows businesses to estimate their processing fees based on various factors.

Conclusion

Understanding Stripe’s credit card processing fees is crucial for businesses to manage their financial operations effectively. By mastering the fee structure, the factors that influence it, and the strategies to optimize it, businesses can make informed decisions that positively impact their bottom line. Remember, Stripe’s transparent and competitive fee structure empowers businesses to optimize their payment processing costs and drive success.

Stripe Credit Card Processing Fee

Stripe, a prominent payment processing platform, charges a per-transaction fee for credit card processing. This fee varies depending on several factors, including the type of card, the transaction amount, and the region where the transaction occurs. Understanding Stripe’s fee structure is crucial for businesses weighing their payment processing options.

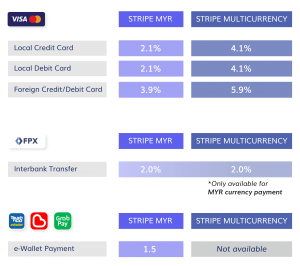

Stripe’s credit card processing fee ranges between 2.9% and 3.9% for most transactions. However, fees can be higher for certain types of cards, such as corporate cards or international cards. Additionally, if the transaction amount exceeds a certain threshold, Stripe may charge an additional fee.

Fee Structure

Stripe’s fee structure comprises various components that determine the total cost of processing a credit card transaction. These components include:

- Percentage fee: Stripe charges a percentage of the transaction amount as a fee. This percentage varies depending on the type of card and the region where the transaction is processed.

- Per-transaction fee: In addition to the percentage fee, Stripe also charges a fixed per-transaction fee. This fee is typically a small amount and is charged regardless of the transaction amount.

- Additional fees: Stripe may charge additional fees for certain types of transactions, such as chargebacks or international transactions. These fees are typically charged in addition to the percentage and per-transaction fees.

Understanding Stripe’s fee structure is essential for businesses as it enables them to estimate the cost of accepting credit card payments. By factoring in the various components of Stripe’s fee structure, businesses can determine whether Stripe’s payment processing services align with their budget and business requirements.

Stripe Credit Card Processing Fees: A Comprehensive Guide for Businesses

Every business that accepts credit card payments needs to be aware of the associated processing fees. Stripe, one of the leading payment gateways, charges a flat fee of 2.9% + 30 cents per transaction for most credit cards. This fee structure is relatively competitive compared to other payment processors, but it’s important to understand the various factors that can affect your processing costs.

Transaction Types

The type of transaction you process can also impact your fees. Here’s a breakdown of the different transaction types and the associated fees:

Swiped Transactions

Swiped transactions are the most common type of credit card transaction. They occur when a customer physically inserts their card into a card reader and swipes it. Stripe charges a flat fee of 2.9% + 30 cents per swiped transaction.

Keyed-In Transactions

Keyed-in transactions occur when a customer’s card number is manually entered into a payment terminal. These transactions are more expensive than swiped transactions because they require additional security measures. Stripe charges a flat fee of 3.5% + 30 cents per keyed-in transaction.

Online Transactions

Online transactions are processed through Stripe’s secure online payment gateway. They are the most convenient option for customers, but they also come with the highest processing fees. Stripe charges a flat fee of 2.9% + 30 cents per online transaction.

Recurring Payments

Recurring payments are a type of transaction that is processed on a regular basis, such as monthly or yearly subscription payments. Stripe charges a flat fee of 2.9% + 30 cents per recurring payment.

International Transactions

International transactions are subject to additional fees because they require currency conversion and cross-border processing. Stripe charges a flat fee of 1% + 30 cents per international transaction.

Additional Fees

In addition to the transaction fees описано above, Stripe may also charge additional fees for certain services, such as:

Chargebacks

Chargebacks occur when a customer disputes a transaction and requests a refund. Stripe charges a flat fee of $15 per chargeback.

Failed Payments

Failed payments occur when a transaction is declined by the customer’s bank. Stripe charges a flat fee of $5 per failed payment.

PCI Compliance Fees

PCI compliance is a set of security standards that businesses must adhere to in order to process credit card payments. Stripe offers a PCI compliance assessment service for a flat fee of $99 per year.

How to Reduce Your Stripe Fees

There are a few things you can do to reduce your Stripe fees, including:

Negotiating a lower rate

If you process a high volume of transactions, you may be able to negotiate a lower rate with Stripe. Contact Stripe’s sales team to discuss your options.

Using a different payment gateway

There are a number of different payment gateways available, each with its own fee structure. Compare the fees of different payment gateways to find one that is right for your business.

Optimizing your payment process

By optimizing your payment process, you can reduce the number of chargebacks and failed payments. This can lead to lower fees overall.

If you’re looking for a reliable and affordable payment gateway, Stripe is a great option. However, it’s important to understand the different fees that Stripe charges before you start using it. By following the tips in this article, you can reduce your Stripe fees and keep more of your hard-earned money.

Stripe Credit Card Processing Fees: A Comprehensive Breakdown for Business Owners

Stripe, a renowned payment gateway, plays a pivotal role in facilitating seamless transactions for countless businesses worldwide. However, understanding the intricate web of processing fees associated with Stripe’s services is paramount for business owners seeking to optimize their financial operations. Credit card transactions, the lifeblood of e-commerce, come with an inherent cost—the processing fee. Stripe, like other payment processors, levies a fee for the convenience of accepting credit card payments, enabling businesses to bypass the hassles of manual processing and potential fraud risks.

Factors Influencing Stripe Credit Card Processing Fees

A myriad of factors contribute to the variability of Stripe’s processing fees, each playing a role in determining the ultimate cost incurred by merchants. Understanding these factors empowers businesses to make informed decisions and minimize their payment processing expenses.

Types of Credit Cards

The type of card used for the transaction wields a significant influence on the processing fee. Premium cards, such as rewards cards and business cards, often attract higher fees due to the additional benefits and rewards they offer to cardholders. Similarly, international transactions, where the card is issued in a country different from the merchant’s location, may incur additional fees to cover currency conversion and cross-border transaction costs.

Transaction Volume

The volume of transactions processed through Stripe also impacts the processing fees. Stripe offers tiered pricing, where businesses with higher transaction volumes qualify for lower processing rates. This volume-based pricing model incentivizes businesses to consolidate their payment processing through Stripe, potentially saving on fees in the long run.

Payment Method

The method of payment selected by the customer can influence the processing fee. While traditional credit card transactions typically incur a higher fee, alternative payment methods, such as ACH transfers or digital wallets, may offer lower processing rates. Businesses should carefully consider the trade-offs between convenience, cost, and customer preferences when selecting payment methods to offer.

Additional Fees

Beyond the base processing fee, Stripe may charge additional fees for specific services or circumstances. These fees can include chargeback fees, which are levied when a customer disputes a transaction, and PCI compliance fees, which are associated with maintaining compliance with industry-standard security protocols. Businesses should familiarize themselves with Stripe’s fee structure to avoid unexpected costs.

Fee Structure and Transparency

Stripe’s fee structure is designed to be transparent and straightforward, enabling businesses to accurately forecast their payment processing costs. The company provides a detailed breakdown of its fees on its website, empowering merchants to make informed decisions about their payment processing strategy. Moreover, Stripe offers a range of tools and resources to help businesses understand and manage their processing fees effectively.

Minimizing Stripe Credit Card Processing Fees

There are several strategies businesses can employ to minimize their Stripe credit card processing fees without compromising the quality of service or customer experience. By optimizing their payment processing practices, businesses can maximize their profits and maintain a competitive edge in the marketplace.

-

Negotiating lower rates: Businesses with high transaction volumes may consider negotiating lower processing rates with Stripe. This is especially beneficial for businesses that have a consistent and predictable flow of transactions.

-

Choosing the right payment methods: Businesses can save on processing fees by offering alternative payment methods, such as ACH transfers or digital wallets, which typically incur lower fees than traditional credit card transactions.

-

Leveraging Stripe’s volume discounts: Stripe’s tiered pricing model provides businesses with an incentive to consolidate their payment processing through Stripe. By increasing transaction volume, businesses can qualify for lower processing rates.

-

Managing chargebacks effectively: Chargebacks can lead to additional fees and lost revenue. Businesses can minimize chargebacks by implementing fraud prevention measures, providing excellent customer service, and resolving disputes promptly and courteously.

Conclusion

Stripe’s credit card processing fees are an unavoidable cost of doing business for many companies. However, by understanding the various factors that influence these fees, businesses can make informed decisions to minimize their expenses and optimize their payment processing strategy. Leveraging Stripe’s tiered pricing, choosing the right payment methods, and managing chargebacks effectively can help businesses keep their processing fees in check while maintaining a seamless and secure payment experience for their customers.

Stripe Credit Card Processing Fee: A Deep Dive

If you’re a business owner, you know that accepting credit cards is a must. But did you also know that the fees associated with processing those payments can eat into your profits? That’s where Stripe comes in. Stripe is a payment processor that offers competitive rates and a variety of features to help businesses save money on their credit card processing.

Stripe charges a flat rate of 2.9% + 30 cents per transaction. This rate is competitive with other payment processors, and it’s even lower for businesses that process a high volume of transactions. Stripe also offers a variety of features that can help businesses save money, such as:

Volume Discounts

Volume Discounts

Stripe offers volume discounts to businesses that process a high volume of transactions. This can significantly reduce the overall processing cost. For example, a business that processes $100,000 in transactions per month would pay a processing fee of 2.6% + 30 cents per transaction. This is a savings of 0.3% compared to the standard rate.

If you’re a business that processes a high volume of transactions, you may be eligible for a volume discount from Stripe. To learn more, contact Stripe’s sales team.

Stripe Credit Card Processing Fees: A Comprehensive Guide for Businesses

The world of e-commerce is ever-evolving, with online transactions becoming increasingly commonplace. As businesses strive to keep pace with the digital landscape, understanding and managing payment processing fees is paramount. Stripe, a leading payment gateway, is a preferred choice for many businesses, and its credit card processing fees are a significant factor to consider when assessing payment solutions. In this article, we’ll delve into the details of Stripe’s credit card processing fees, empowering you with the knowledge to make informed decisions for your business.

Stripe Credit Card Processing Fee

Stripe’s credit card processing fee structure is straightforward and competitive. For most businesses, the standard transaction fee is 2.9% + $0.30 per successful transaction. This fee encompasses the interchange fee (paid to the card-issuing bank), Stripe’s processing fee, and assessment fees (paid to card networks like Visa and Mastercard). However, it’s important to note that specific industries or high-volume merchants may incur variable rates, which we’ll explore later.

Additional Fees

Besides the per-transaction fee, Stripe may apply additional fees for certain services, such as chargebacks, currency conversion, and PCI compliance. It’s important to be aware of these potential expenses to accurately budget for payment processing costs.

Chargebacks

Chargebacks occur when a customer disputes a transaction and requests a refund through their issuing bank. Stripe charges a fee of $15 for each chargeback, regardless of the outcome of the dispute. Businesses should strive to minimize chargebacks by implementing robust fraud prevention measures and providing excellent customer service.

Currency Conversion

If your business accepts payments from customers in different currencies, Stripe charges a currency conversion fee of 1% on top of the standard transaction fee. This fee is incurred when Stripe converts the transaction amount from the customer’s currency to your business’s currency. It’s worth considering if your business operates in multiple geographies and generates a significant volume of cross-currency transactions.

PCI Compliance

PCI (Payment Card Industry) compliance is essential for businesses that store, process, or transmit credit card data. Stripe offers PCI compliance tools and support to help businesses safeguard sensitive payment information. However, these services come with an additional fee, which varies depending on the level of support required.

Factors Affecting Stripe’s Credit Card Processing Fees

Several factors can influence the Stripe credit card processing fees your business incurs. Understanding these factors can help you optimize your payment strategy and minimize unnecessary expenses.

Business Type and Industry

Certain industries, such as non-profits, healthcare providers, and subscription-based businesses, may qualify for lower processing rates. Stripe considers the risk associated with each industry and adjusts its fees accordingly.

Transaction Volume

High-volume merchants often negotiate lower processing rates with Stripe. As transaction volumes increase, Stripe may offer tiered pricing or volume discounts to incentivize businesses to process payments through their platform.

Payment Method

Different payment methods, such as credit cards, debit cards, and ACH transfers, incur varying processing fees. Credit card transactions typically have higher fees due to the higher risk of fraud and chargebacks associated with them.

Additional Services

Stripe offers a suite of additional services, such as fraud prevention tools, reporting dashboards, and subscription management. Using these services may incur additional fees, which should be factored into your payment processing budget.

Comparing Stripe’s Fees to Competitors

When evaluating Stripe’s credit card processing fees, it’s prudent to compare them to those of other payment gateways. While Stripe’s fees are generally competitive, some providers may offer lower rates for specific industries or payment methods. Conduct thorough research and consider your business’s specific needs before making a decision.

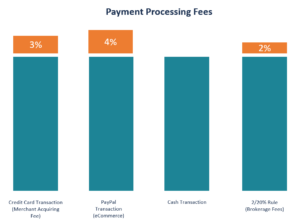

PayPal

PayPal is another popular payment gateway with a similar fee structure to Stripe’s. PayPal’s standard transaction fee is 2.9% + $0.30 per transaction, but it also offers tiered pricing for high-volume merchants. PayPal typically charges higher fees for cross-border transactions and currency conversions.

Square

Square is a leading provider of integrated payment solutions for small businesses. Its fees are slightly higher than Stripe’s, with a standard transaction fee of 2.6% + $0.10 per transaction. Square offers a variety of hardware and software solutions that may appeal to businesses seeking an all-in-one payment solution.

Braintree

Braintree, a PayPal company, provides payment processing solutions for online and mobile businesses. Its pricing is similar to Stripe’s, with a standard transaction fee of 2.9% + $0.30 per transaction. Braintree offers a range of advanced features, such as tokenization and recurring billing, which may be beneficial for certain businesses.

FAQs

To provide further clarity, let’s delve into some commonly asked questions regarding Stripe’s credit card processing fees:

1. Are there any hidden fees associated with Stripe?

Stripe prides itself on transparency and discloses all fees upfront. There are no hidden fees or surprises when using Stripe’s services.

2. Can I negotiate Stripe’s processing fees?

Yes, high-volume merchants or businesses in specific industries may be eligible for negotiated rates. Reach out to Stripe’s sales team to inquire about potential discounts or custom pricing.

3. How can I reduce my Stripe processing fees?

Consider using alternative payment methods with lower fees, such as ACH transfers or debit cards. Additionally, implementing fraud prevention measures and minimizing chargebacks can help lower your overall processing costs.

Conclusion

Understanding Stripe’s credit card processing fees is crucial for businesses to make informed decisions about their payment processing strategy. By carefully considering the factors that influence fees and comparing Stripe to competitors, businesses can optimize their payment solutions and minimize unnecessary expenses. It’s advisable to consult with a payment processing expert or Stripe’s support team if you have any further questions or require guidance tailored to your business’s specific needs.

Stripe Credit Card Processing Fees: A Comprehensive Guide

Stripe, a leading online payment processor, has become a popular choice for businesses of all sizes due to its user-friendly platform and competitive fees. Understanding Stripe’s credit card processing fees is crucial for any business considering using their services. In this article, we’ll dive into the details of Stripe’s fee structure, exploring its transparency, flexibility, and other key aspects.

Flat Fees and Interchangeable Rates

Stripe charges a flat fee of 2.9% + $0.30 per transaction for all major credit cards. This rate applies to both in-person and online transactions. Additionally, for American Express cards, Stripe charges an additional 0.4%. These fees are consistent across the board, providing businesses with predictable and transparent pricing.

Transparency and Flexibility

Stripe shines in terms of transparency, offering clear fee rates and comprehensive documentation. Businesses can easily access detailed breakdowns of their fees on their Stripe dashboard, ensuring they have a full understanding of the costs involved. Moreover, Stripe allows businesses to adjust their pricing plans seamlessly. They can opt for a custom pricing plan that fits their specific needs or integrate Stripe’s API into their systems to tailor the fee structure to their operations.

No Hidden Fees

Stripe is committed to eliminating hidden fees and surprises. They charge a clear and upfront flat fee, without any additional charges or surcharges. This ensures that businesses can confidently budget for their payment processing costs and avoid unexpected expenses.

Easy Dispute Management

Handling payment disputes can be a headache for businesses. Stripe simplifies the process by providing a customer-friendly dispute management system. Businesses can easily view and respond to disputes, providing evidence and documentation to support their case. Stripe’s efficient dispute resolution process helps minimize the impact of chargebacks on your business.

Advanced Reporting and Analytics

Stripe offers robust reporting and analytics tools to help businesses track their payment performance. With easy-to-understand dashboards and detailed transaction data, businesses can gain valuable insights into their revenue, churn rates, and customer behavior. This information enables them to make data-driven decisions to optimize their payment strategies.

Support and Resources

Stripe’s commitment to customer support is evident in its comprehensive documentation, online resources, and responsive support team. Businesses can access a vast knowledge base of articles, tutorials, and guides to help them understand and use Stripe’s services effectively. Additionally, they can reach out to Stripe’s support team via phone, email, or live chat for personalized assistance.

Security and Compliance

Security is paramount for any online payment processor. Stripe adheres to the highest industry standards, including PCI DSS Level 1 compliance, to protect sensitive customer data. They employ advanced encryption technologies and fraud detection algorithms to prevent data breaches and safeguard businesses from fraudulent activities.

Conclusion

Stripe’s credit card processing fees are designed to provide businesses with a transparent, flexible, and cost-effective solution. With its flat fees, no hidden charges, and advanced features, Stripe empowers businesses to streamline their payment operations and focus on growth. Whether you’re a small startup or a large enterprise, Stripe’s customizable pricing plans and commitment to customer support make it an ideal choice for any business looking to accept online payments seamlessly.

Stripe Credit Card Processing Fees: A Comprehensive Guide for Businesses

In the ever-evolving landscape of e-commerce, businesses rely heavily on efficient and cost-effective payment processing solutions. Enter Stripe, a leading provider in the industry. Its credit card processing fees have garnered much attention, making it crucial for businesses to have a clear understanding of their fee structure and dynamics to optimize their payment strategies.

Transaction Fees

The foundation of Stripe’s fee structure lies in transaction fees, which typically range between 2.9% and 3.9% plus $0.30 per successful transaction. This means that for a $100 purchase, Stripe’s fee would be $3.20. Additionally, specific transaction types may incur additional fees, such as international transactions or chargebacks. Understanding these base fees is paramount for businesses to accurately forecast their payment processing expenses.

Interchange Rates

Interchange rates, often denoted as the “wholesale” cost of card transactions, are determined by card networks like Visa, Mastercard, and American Express. These rates vary based on factors such as the card type, transaction type, and cardholder’s country. Stripe typically passes these interchange rates directly to merchants, ensuring transparency and enabling businesses to have a clear picture of their processing costs.

Assessment Fees

Assessment fees, also known as network fees, are levied by card networks in addition to interchange rates. These fees contribute to the infrastructure and security of the card payment ecosystem. Stripe incorporates these fees into its pricing model, allowing businesses to consolidate their payment processing costs into a single, streamlined platform.

Authorization Fees

Authorization fees are incurred each time a customer’s card is authorized for a transaction. Stripe charges $0.25 per authorization attempt, regardless of whether the transaction is ultimately completed. This fee helps cover the cost of processing the authorization request and provides businesses with a clear understanding of their payment processing volume.

PCI Compliance Fees

PCI (Payment Card Industry) compliance is a crucial aspect of payment processing, ensuring the security of customer card data. Stripe offers PCI compliance as part of its service, helping businesses meet industry standards and protect against data breaches. The cost of PCI compliance varies depending on the level of support required, with Stripe providing flexible options tailored to businesses’ specific needs.

Chargeback Fees

Chargebacks occur when customers dispute a transaction and request a refund. Stripe charges a fee of $15 for each chargeback processed, covering the costs associated with investigating and resolving disputes. Understanding chargeback fees is essential for businesses to mitigate potential revenue loss and proactively manage customer disputes.

Dispute Fees

Dispute fees are levied by card networks when a customer initiates a dispute related to a transaction. Stripe offers dispute management services to assist businesses in resolving disputes, with fees varying depending on the complexity and resolution of the case. These fees cover the costs incurred by card networks and Stripe in facilitating the dispute resolution process.

Additional Fees and Considerations

Beyond the core fee structure, Stripe provides various additional services and features that may incur additional fees. These include:

- Custom payment gateways

- Subscription management

- Invoicing

- International expansion

Businesses should carefully consider their payment processing needs and the associated fees to determine the most cost-effective solution. Stripe offers a transparent and flexible pricing model, enabling merchants to tailor their payment processing strategy to their specific requirements.

Conclusion

Stripe’s credit card processing fees are designed to provide businesses with a competitive and customizable payment solution. By understanding the various components of the fee structure, including transaction fees, interchange rates, and additional services, businesses can make informed decisions about their payment processing strategy. Stripe’s flexible pricing model empowers merchants to optimize their revenue streams and effectively manage their payment processing costs, ultimately contributing to their overall business success.