Visa Credit Card Processing Fee

Posted: 02 Apr 2025 on General

Visa Credit Card Processing Fee

Credit cards are a convenient way to pay for goods and services, but they come with a cost to businesses. Every time a customer uses a credit card, the merchant has to pay a processing fee. This fee is typically a percentage of the transaction amount, and it can add up quickly for businesses that process a lot of credit card payments.

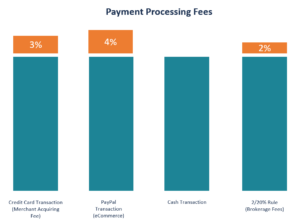

The average credit card processing fee is around 2%, but it can vary depending on the type of credit card, the merchant’s account, and the payment processor. For example, Visa, one of the largest credit card companies in the world, charges a processing fee of 1.5% for Visa Signature cards and 2.5% for Visa Classic cards.

In addition, some payment processors charge additional fees, such as a monthly fee or a per-transaction fee. It’s important to compare the fees charged by different processors before choosing one.

There are a few things businesses can do to reduce their credit card processing fees. One is to negotiate with their payment processor for a lower rate. Another is to offer discounts to customers who pay with cash or debit cards. Finally, businesses can increase their sales volume to spread the cost of processing fees over a larger number of transactions.

Factors that Affect Processing Fees

Credit card processing fees are determined by a number of factors, including:

How to Reduce Processing Fees

There are a few things businesses can do to reduce their credit card processing fees, such as:

Conclusion

Credit card processing fees are a common cost of doing business, but there are a few things businesses can do to reduce them. If you understand the factors that affect processing fees, you can make informed decisions to reduce your costs and increase your profits.

Visa Credit Card Processing Fee: An In-Depth Examination

In the intricate tapestry of modern commerce, the Visa credit card looms large as a ubiquitous payment tool. Yet, beneath its sleek facade lies a hidden cost that merchants shoulder: the Visa credit card processing fee. This levy, often overlooked in the flurry of transactions, plays a crucial role in the smooth functioning of the payment ecosystem.

Reasons for the Fee

The Visa credit card processing fee is not a mere whim of financial institutions; it serves several essential purposes. These charges defray the costs associated with processing Visa transactions, safeguarding them against fraud and ensuring efficient customer service. Fraud prevention, a constant battle in the digital age, requires advanced technologies and dedicated teams to protect merchants from fraudulent charges. The processing fee helps subsidize these investments, ensuring the integrity of the payment system.

Customer service is another vital aspect that the processing fee supports. When customers encounter issues with Visa transactions, they expect swift and effective assistance. The processing fee provides the resources necessary to maintain a robust customer service infrastructure, ensuring that merchants have a reliable point of contact for resolving transaction-related queries.

Impact on Merchants

The Visa credit card processing fee is not a trivial expense for merchants. It can account for a significant portion of their operating costs, especially for small businesses with slim margins. The burden of this fee can impact pricing decisions, potentially translating into higher prices for consumers. Moreover, merchants must carefully consider the fee structure to optimize their payment processing strategy and minimize unnecessary costs.

Assessing the Fee’s Fairness

The fairness of the Visa credit card processing fee is a subject of ongoing debate. Some argue that it places an unfair burden on merchants, especially given the substantial profits generated by Visa from transaction fees. Others maintain that the fee is justified, given the value-added services that Visa provides, such as fraud protection and customer service.

Conclusion

The Visa credit card processing fee is an essential component of the payment ecosystem, providing funding for fraud prevention, customer service, and other vital operations. While it can be a significant expense for merchants, it also brings tangible benefits that enhance the security and efficiency of Visa transactions. Understanding the reasons for the fee and its impact on businesses is crucial for informed decision-making and a fair assessment of its fairness.

Visa Credit Card Processing Fees: A Comprehensive Guide

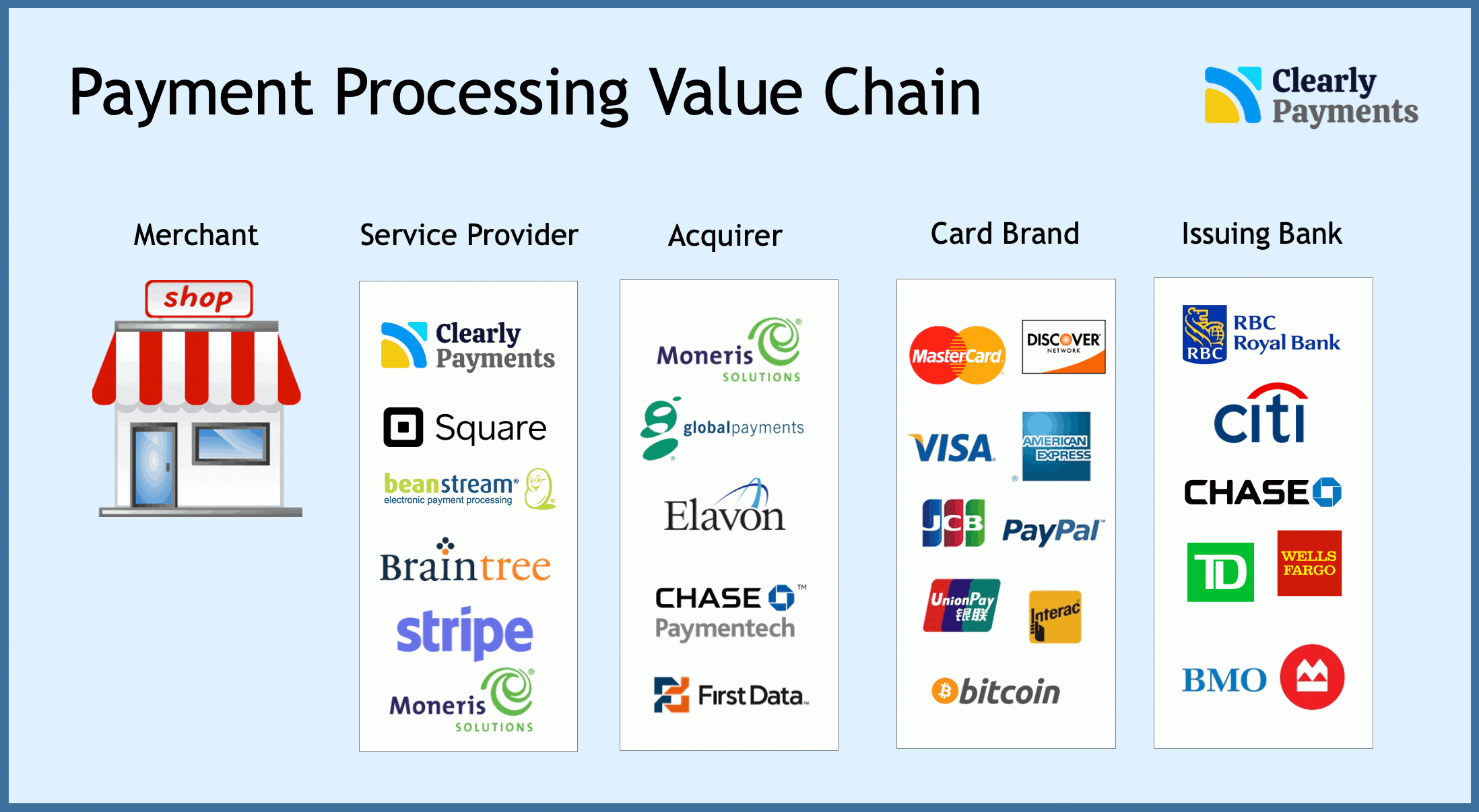

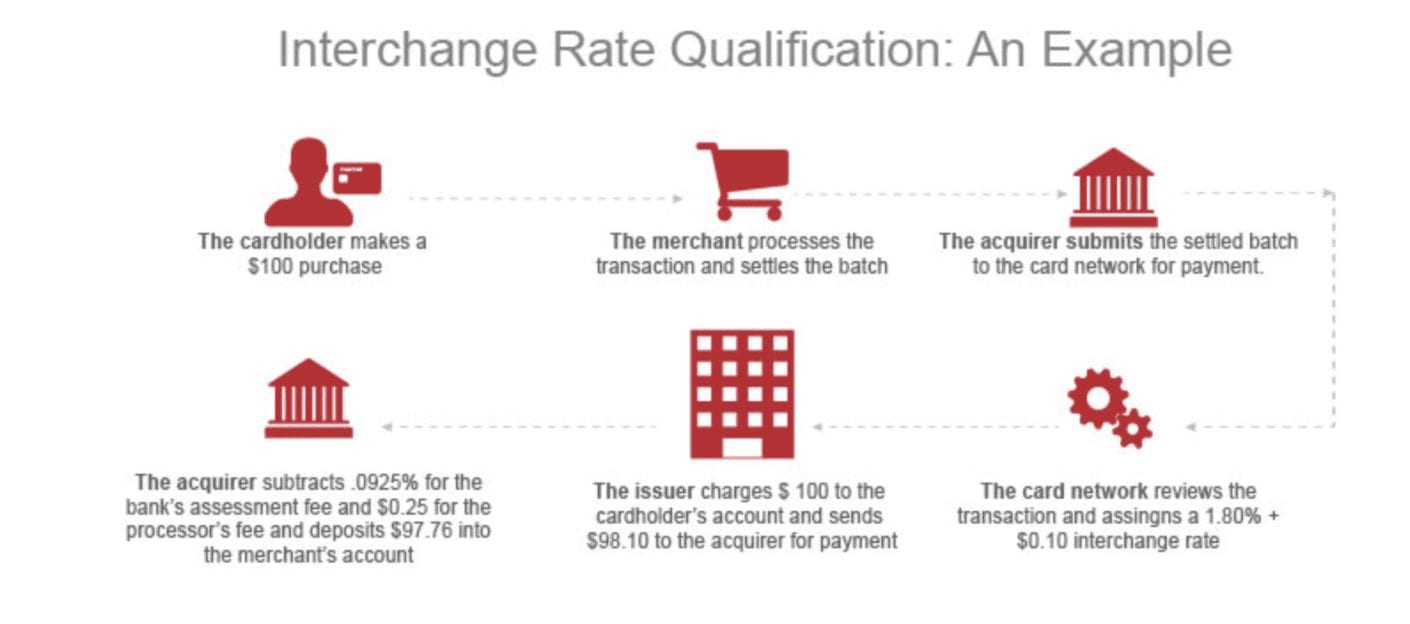

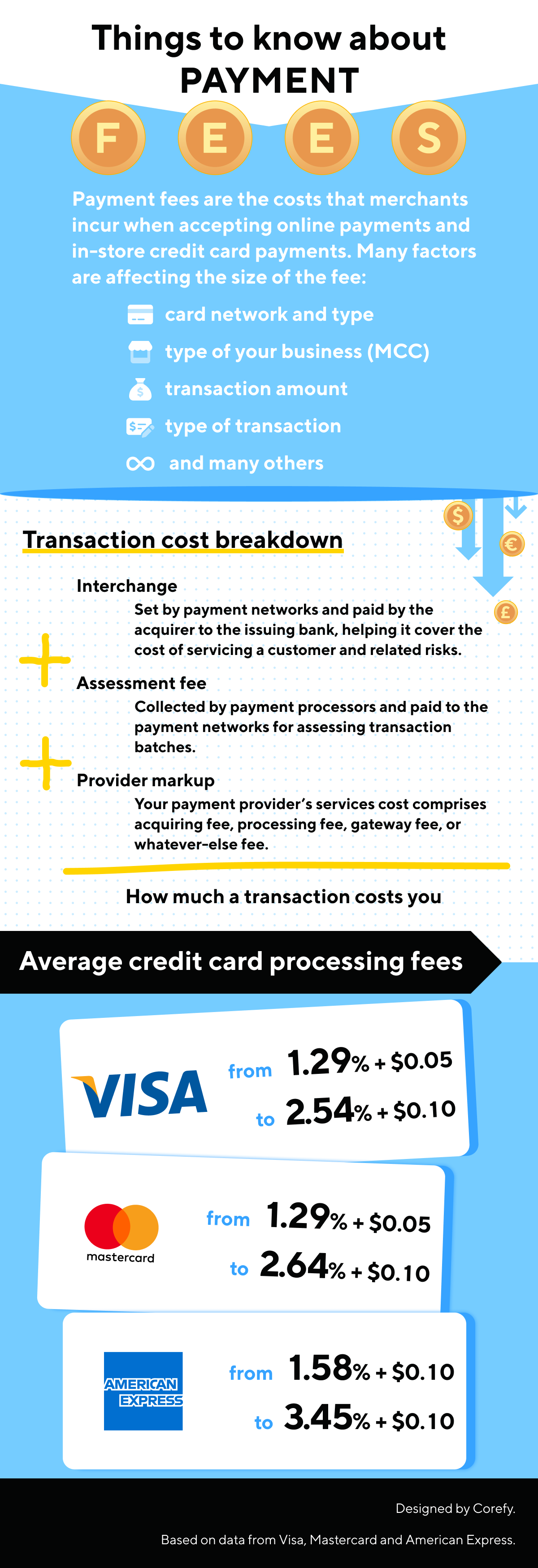

Processing Visa credit card transactions comes with a set of fees that can impact your business’s bottom line. Understanding these fees is crucial for making informed decisions about payment processing solutions. Visa charges two main types of fees: interchange fees and assessments.

Different Types of Fees

Interchange Fees

Interchange fees are the charges that Visa assesses on each transaction and are paid to the issuing bank of the cardholder. These fees vary based on factors such as the type of card used, the transaction amount, and the merchant’s industry. Interchange fees typically account for the largest portion of credit card processing costs for businesses.

Assessments

Assessments are fees charged by Visa itself to cover the costs of its network, security, and other operations. These fees include:

1. **Annual Membership Fee:** The fee paid by merchants to maintain a Visa merchant account.

2. **Merchant Account Statement Fee:** The fee for receiving monthly statements detailing transactions.

3. **Transaction Assessment:** The fee for each Visa transaction processed.

4. **PCI Compliance Fee:** The fee for merchants who must comply with Visa’s Payment Card Industry Data Security Standard (PCI DSS).

5. **Chargeback Fee:** The fee charged when customers dispute a transaction and request a chargeback.

Calculating Visa Processing Fees

The total Visa credit card processing fee for each transaction can be calculated using the following formula:

**Interchange Fee + Assessment = Total Processing Fee**

For example, if the interchange fee for a particular transaction is 2.5% and the transaction assessment is $0.20, the total processing fee would be 2.7%. This means that for every $100 transaction, the merchant would pay $2.70 in processing fees.

Factors Affecting Processing Fees

Several factors can influence the Visa credit card processing fees a business pays, including:

- **Card type:** Visa offers different card types with varying interchange rates. Premium cards like Visa Signature and Visa Infinite typically have higher interchange fees than standard cards.

- **Transaction type:** In-person transactions and online transactions have different interchange rates.

- **Merchant category code (MCC):** Visa assigns merchants an MCC based on their industry, which can impact interchange rates.

- **Merchant volume:** Merchants who process a high volume of transactions may be eligible for lower interchange rates.

- **Negotiated rates:** Merchants can negotiate interchange rates with their payment processor.

Minimizing Processing Fees

Businesses can take steps to minimize Visa credit card processing fees, such as:

- **Negotiating with payment processors:** Merchants can negotiate lower interchange rates with their payment processors by leveraging their business volume or negotiating a tiered pricing structure.

- **Accepting lower-cost cards:** Merchants can encourage customers to use lower-cost card types with lower interchange rates.

- **Optimizing transaction types:** Merchants can prioritize in-person transactions over online transactions, as in-person transactions typically have lower interchange rates.

- **Reviewing MCC:** Merchants can ensure that they are assigned the correct MCC, as incorrect MCCs can lead to higher interchange rates.

Conclusion

Visa credit card processing fees are an important consideration for businesses that accept credit cards. Understanding the different types of fees and the factors that affect them can help businesses make informed decisions about payment processing solutions. By minimizing processing fees, businesses can reduce their operating costs and maximize their profits.

Visa Credit Card Processing Fees: Tips for Saving Money

Introduction

Visa, one of the world’s leading payment networks, charges fees for processing credit card transactions. These fees can vary based on factors like the type of card used, the transaction amount, and the merchant’s location. The standard Visa processing fee is 1.5% to 3.5% of the transaction amount, with additional fees for certain types of transactions, such as international payments or chargebacks.

Understanding Visa Credit Card Processing Fees

Visa charges several types of fees for credit card processing. These fees include:

- Interchange fee: A fee paid by the merchant’s bank to the card-issuing bank.

- Assessment fee: A fee paid by the merchant’s bank to Visa.

- Gateway fee: A fee paid by the merchant to the payment gateway that processes the transaction.

Tips for Reducing Fees

Merchants can take several steps to reduce their Visa credit card processing fees:

1. Negotiate with Your Payment Processor

Negotiating with your payment processor can often lead to lower fees. Contact your processor and ask for a lower rate. If your volume of transactions is high, you may be eligible for a better deal. It’s worth shopping around for different processors to find the best rates.

2. Choose a Processor with Lower Fees

Different payment processors charge different fees. Compare the fees offered by different processors before choosing one. Consider factors such as the monthly fee, per-transaction fee, and any additional fees.

3. Use a Payment Gateway that Optimizes Transactions

A payment gateway can help optimize transactions and reduce fees. A good gateway will route transactions to the most cost-effective processor and provide features such as fraud protection and reporting.

4. Offer Incentives for Customers to Use Other Payment Methods

If possible, offer incentives for customers to use alternative payment methods, such as cash, debit cards, or ACH payments. These payment methods typically have lower processing fees than credit cards. You could offer discounts or loyalty points for using these methods.

5. Increase Your Sales Volume

Increasing your sales volume can lower your effective processing fees. As your volume increases, you’ll negotiate lower rates with your payment processor. Also, as your sales volume increases, the fixed costs of processing each transaction will be spread over a larger number of transactions, resulting in a lower per-transaction cost.

6. Review Your Processing Statements Regularly

Regularly review your processing statements to identify any areas where you can save money. You may find that you’re being charged for services you don’t need or that your rates have increased without your knowledge. By staying on top of your processing statements, you can ensure you’re getting the best possible deal.

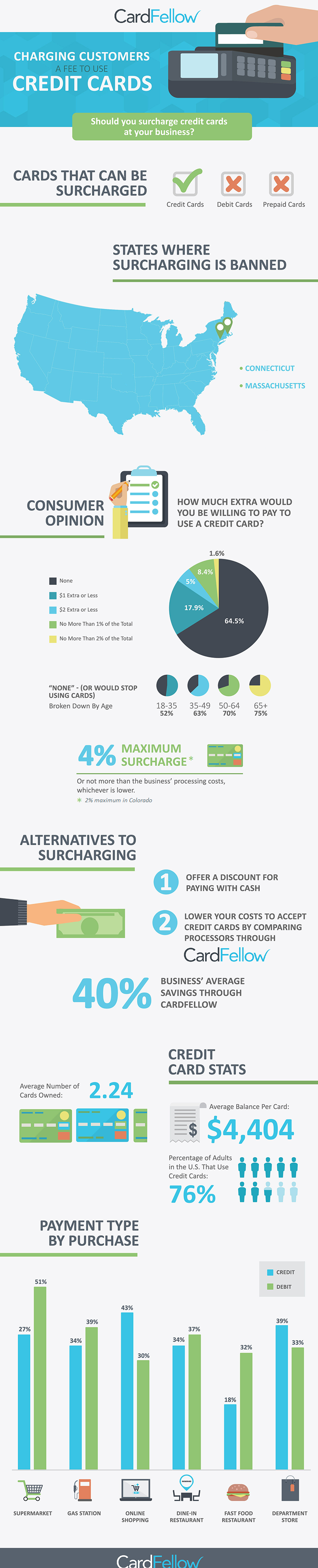

7. Consider Surcharging for Credit Card Transactions

In some cases, it may be possible to surcharge customers for using credit cards. This can help offset the cost of processing fees. However, it’s important to check the laws in your jurisdiction before implementing a surcharge.

Visa Credit Card Processing Fees: An Essential Breakdown for Merchants

In today’s digital marketplace, Visa credit cards reign supreme as a convenient and secure payment method for countless businesses. However, with this convenience comes a hidden cost: Visa credit card processing fees. These fees, charged to merchants for each Visa transaction, can add up quickly, impacting a business’s profitability. Understanding these fees is paramount for merchants who want to maximize their revenue and avoid unexpected expenses.

Visa credit card processing fees typically range from 1.5% to 3.5% of each transaction, depending on the type of card used, the merchant’s industry, and the volume of transactions processed. For instance, businesses processing high volumes of Visa transactions may qualify for lower rates. Additionally, some merchants may incur additional fees, such as chargeback fees or interchange fees.

Consequences of Not Paying Fees

Merchants who fail to pay their Visa credit card processing fees may face severe consequences, including fines and penalties. Visa has a strict policy of enforcing these fees, and non-payment can result in:

- Suspension or termination of merchant account

- Legal action

- Damage to a business’s reputation

Therefore, it is imperative that merchants stay up-to-date on their processing fees and make timely payments to avoid any potential risks.

Breaking Down the Fees

Visa credit card processing fees are typically divided into three main components:

- Interchange fees: These fees are paid by the merchant’s bank to the issuing bank of the customer’s card. Interchange fees vary depending on the type of card used and the transaction amount.

- Assessment fees: These fees are charged by Visa to cover the costs of maintaining and operating its network.

- Network access fees: These fees are charged by the merchant’s payment processor to cover the costs of connecting to the Visa network.

Understanding how these components contribute to the overall processing fee is crucial for merchants who want to minimize their expenses.

Tips for Negotiating Fees

While Visa sets the base rates for its processing fees, merchants may have some wiggle room for negotiation. Here are some effective tips:

- Increase transaction volume: Processing a higher volume of Visa transactions can often lead to lower rates.

- Qualify for Interchange Plus: This pricing model allows merchants to pay only the interchange fee plus a fixed assessment fee, which can result in lower overall costs.

- Negotiate with your payment processor: Payment processors may be willing to offer reduced rates to merchants who process large volumes of transactions or have a proven history of low chargebacks.

Conclusion

Visa credit card processing fees are an unavoidable expense for merchants who accept Visa cards. By understanding the different types of fees, their impact on a business’s profitability, and the potential consequences of non-payment, merchants can make informed decisions about their payment processing strategies. Furthermore, by implementing negotiation tactics, merchants can minimize their fees and maximize their revenue, ensuring the continued success of their businesses.